Question: Problem 7. Kitto Electronics has an EBIT of $200,000, a growth rate of 6%, and its tax rate is 40%. In order to support growth,

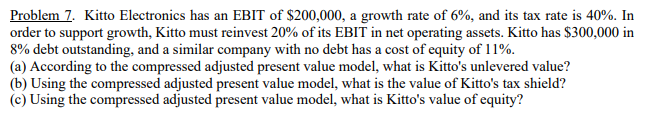

Problem 7. Kitto Electronics has an EBIT of $200,000, a growth rate of 6%, and its tax rate is 40%. In order to support growth, Kitto must reinvest 20% of its EBIT in net operating assets. Kitto has $300,000 in 8% debt outstanding, and a similar company with no debt has a cost of equity of 11%. (a) According to the compressed adjusted present value model, what is Kitto's unlevered value? (b) Using the compressed adjusted present value model, what is the value of Kitto's tax shield? c) Using the compressed adjusted present value model, what is Kitto's value of equity

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock