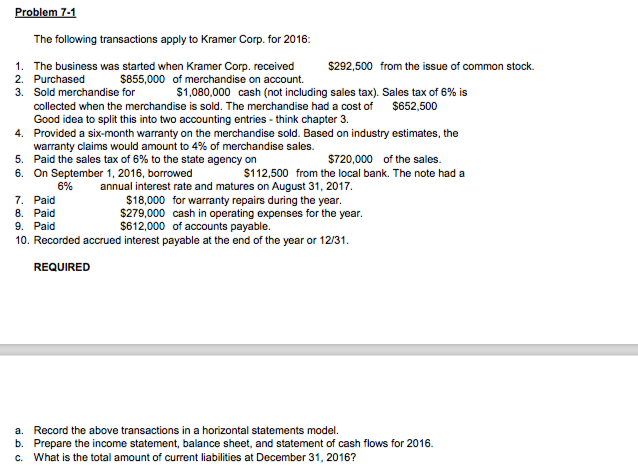

Question: Problem 7-1 The following transactions apply to Kramer Corp. for 2016 1. The business was started when Kramer Corp. received $292,500 from the issue of

Problem 7-1 The following transactions apply to Kramer Corp. for 2016 1. The business was started when Kramer Corp. received $292,500 from the issue of common stock. $855,000 of merchandise on account. 3. $1,080,000 cash (not including sales tax). Sales tax of 6% is Sold merchandise for collected when the merchandise is sold. The merchandise had a cost of Good idea to split this into two accounting entries-think chapter 3. Provided a six-month warranty on the merchandise sold. Based on industry estimates, the warranty claims would amount to 4% of merchandise sales. Paid the sales tax of 6% to the state agency on On September 1, 2016, borrowed $652,500 4. $720,000 S112,500 from the local bank. The note had a of the sales. 5. 6. 6% annual interest rate and matures on August 31, 2017 7. Paid 8. Paid 9. Paid 10. Recorded accrued interest payable at the end of the year or 12/31 $18,000 for warranty repairs during the year. $279,000 cash in operating expenses for the year $612,000 of accounts payable REQUIRED a. b. c. Record the above transactions in a horizontal statements model. Prepare the income statement, balance sheet, and statement of cash flows for 2016. What is the total amount of current liabilities at December 31, 2016

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts