Question: Problem 7-19 (algorithmic) Question Help those four years of A company purchases an industrial laser for $128,000. The device has $55,000. The before-tax cash flow

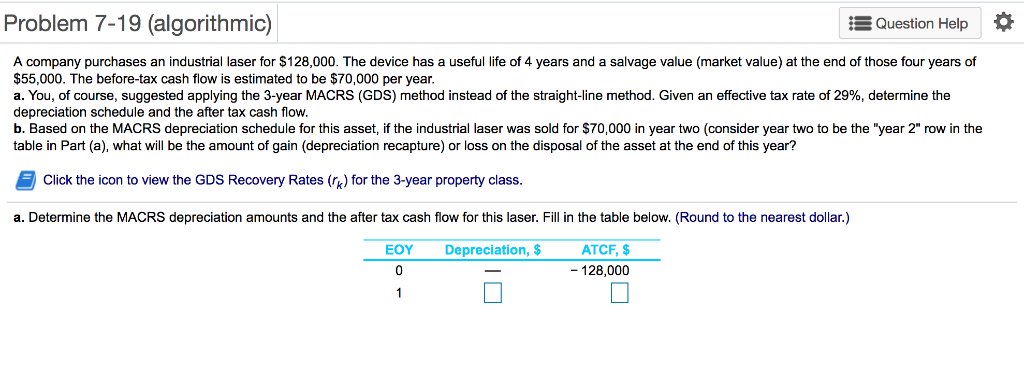

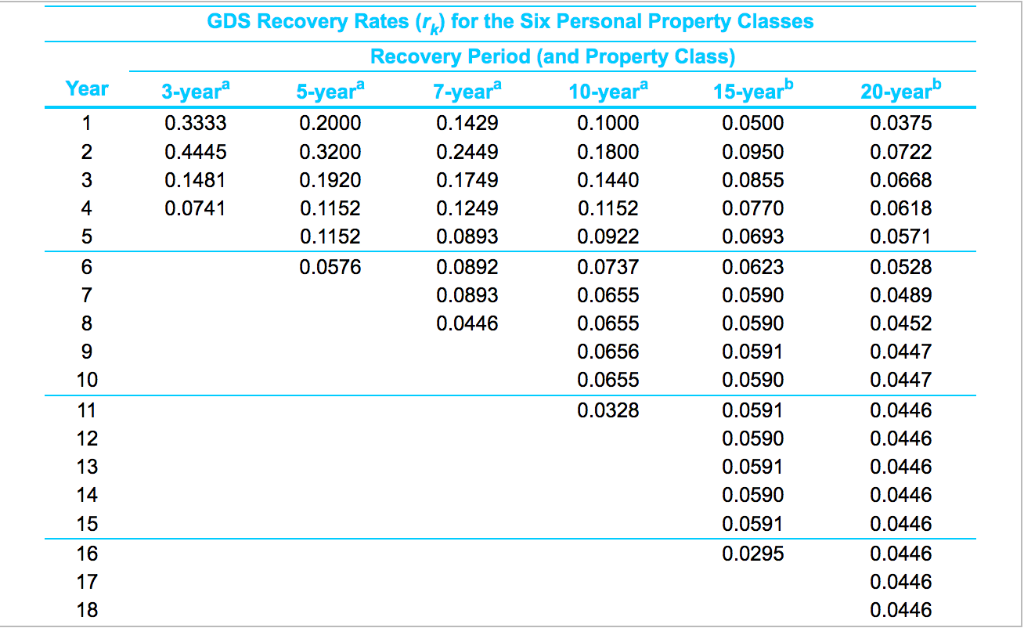

Problem 7-19 (algorithmic) Question Help those four years of A company purchases an industrial laser for $128,000. The device has $55,000. The before-tax cash flow is estimated to be $70,000 per year. a. You, of course, suggested applying the 3-year MACRS (GDS) method instead of the straight-line method. Given an effective tax rate of 29%, determine the depreciation schedule and the after tax cash flow. b. Based on the MACRS depreciation schedule for this asset, if the industrial laser was sold for $70,000 in year two (consider year two table in Part (a), what will be the amount of gain (depreciation recapture) or loss on the disposal of the asset at the end of this year? useful life of 4 years and a salvage value (market value) at the end be the "year 2" row in the Click the icon to view the GDS Recovery Rates () for the 3-year property class. a. Determine the MACRS depreciation amounts and the after tax cash flow for this laser. Fill in the table below. (Round to the nearest dollar.) EOY Depreciation, $ ATCF, $ 0 -128,000 1 GDS Recovery Rates (r) for the Six Personal Property Classes Recovery Period (and Property Class) 15-year Year 3-yeara 5-yeara 10-yeara 7-year 20-yearb 0.3333 0.1000 1 0.2000 0.1429 0.0500 0.0375 2 0.4445 0.3200 0.2449 0.1800 0.0950 0.0722 0.1749 3 0.1481 0.1920 0.1440 0.0855 0.0668 0.0741 0.1152 4 0.1249 0.1152 0.0770 0.0618 5 0.0893 0.0922 0.1152 0.0693 0.0571 6 0.0576 0.0892 0.0737 0.0623 0.0528 7 0.0893 0.0655 0.0590 0.0489 0.0446 8 0.0655 0.0590 0.0452 0.0656 0.0591 0.0447 10 0.0590 0.0447 0.0655 11 0.0328 0.0591 0.0446 12 0.0590 0.0446 13 0.0591 0.0446 14 0.0590 0.0446 15 0.0446 0.0591 16 0.0295 0.0446 17 0.0446 18 0.0446

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts