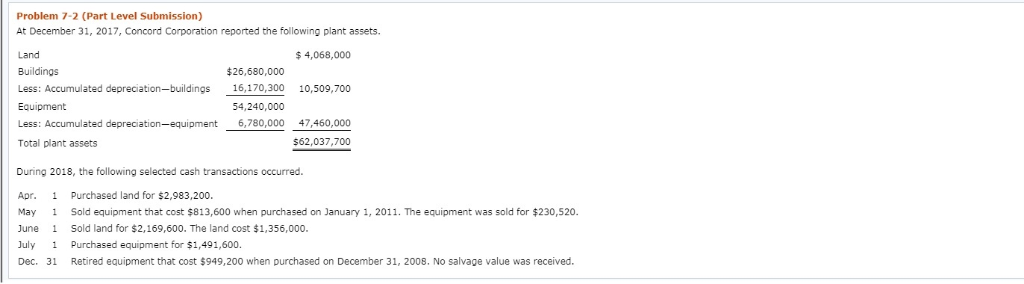

Question: Problem 7-2 (Part Level Submission) At December 31, 2017, Concord Corporation reported the following plant assets. Land Buildings Less: Accumulated depreciation-buildings 16,170,300 10,509,700 Equipment Less:

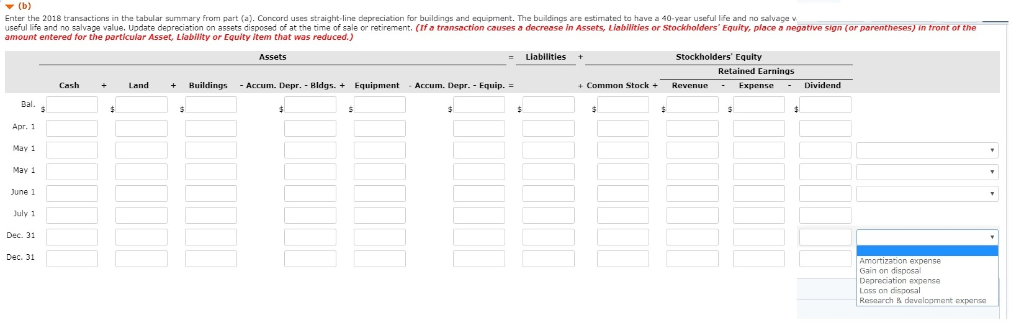

Problem 7-2 (Part Level Submission) At December 31, 2017, Concord Corporation reported the following plant assets. Land Buildings Less: Accumulated depreciation-buildings 16,170,300 10,509,700 Equipment Less: Accumulated depreciation-equipment,780,000 47460,000 Total plant assets $ 4,068,000 $26,680,000 54,240,000 562,037,700 During 2018, the following selected cash transactions occurred. Apr. 1 Purchased land for $2,983,200 May 1 Sold equipment that cost $813,600 when purchasedon January 1, 2011. The equipment was sold for $230,520. June Sold land for $2,169,600. The land cost $1,356,000. July 1 Purchased equipment for $1,491,600. Dec. 31 Retired equipment that cost $949,200 when purchased on December 31, 2008. No salvage value was received Enter the 2018 transactions in the tabular summary from part (a). Concord uses straight-line depreciation for buildings and equipment. The buildings are estimated to have a 40-year useful life and no salvage useful e and no salvage value. Update deprec ation on assets disposed of at the D e of sale or retirement. If transact on causes decrease in Assets, Liabilities or Stockholders' Equity, place , negative sign or parentheses in tront of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Assets -Llabilitles + Stockholders Equity Retained Earnings Cash nd + Buildings -Accurn. Depr.-Bldgs. + Equipment Accum. Depr.-Equip. = + Common StockRevenue Dividend Bal. Apr. 1 May 1 May 1 June 1 July 1 Dec. 31 Dec. 31 Amortizaton expense Gain on disposal Dreation expense Loss on disposal Problem 7-2 (Part Level Submission) At December 31, 2017, Concord Corporation reported the following plant assets. Land Buildings Less: Accumulated depreciation-buildings 16,170,300 10,509,700 Equipment Less: Accumulated depreciation-equipment,780,000 47460,000 Total plant assets $ 4,068,000 $26,680,000 54,240,000 562,037,700 During 2018, the following selected cash transactions occurred. Apr. 1 Purchased land for $2,983,200 May 1 Sold equipment that cost $813,600 when purchasedon January 1, 2011. The equipment was sold for $230,520. June Sold land for $2,169,600. The land cost $1,356,000. July 1 Purchased equipment for $1,491,600. Dec. 31 Retired equipment that cost $949,200 when purchased on December 31, 2008. No salvage value was received Enter the 2018 transactions in the tabular summary from part (a). Concord uses straight-line depreciation for buildings and equipment. The buildings are estimated to have a 40-year useful life and no salvage useful e and no salvage value. Update deprec ation on assets disposed of at the D e of sale or retirement. If transact on causes decrease in Assets, Liabilities or Stockholders' Equity, place , negative sign or parentheses in tront of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Assets -Llabilitles + Stockholders Equity Retained Earnings Cash nd + Buildings -Accurn. Depr.-Bldgs. + Equipment Accum. Depr.-Equip. = + Common StockRevenue Dividend Bal. Apr. 1 May 1 May 1 June 1 July 1 Dec. 31 Dec. 31 Amortizaton expense Gain on disposal Dreation expense Loss on disposal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts