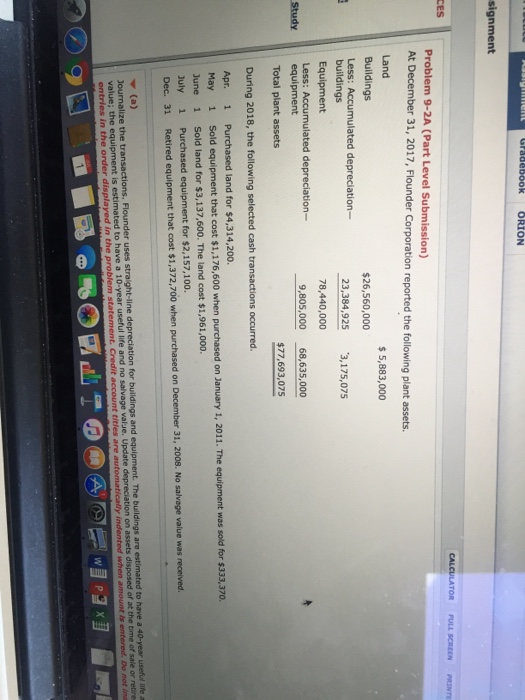

Question: signment CES Problem 9-2A (Part Level Submission) At December 31, 2017, Flounder Corporation reported the following plant assets. Land Buildings Less: Accumulated depreciation- buildings Equipment

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock