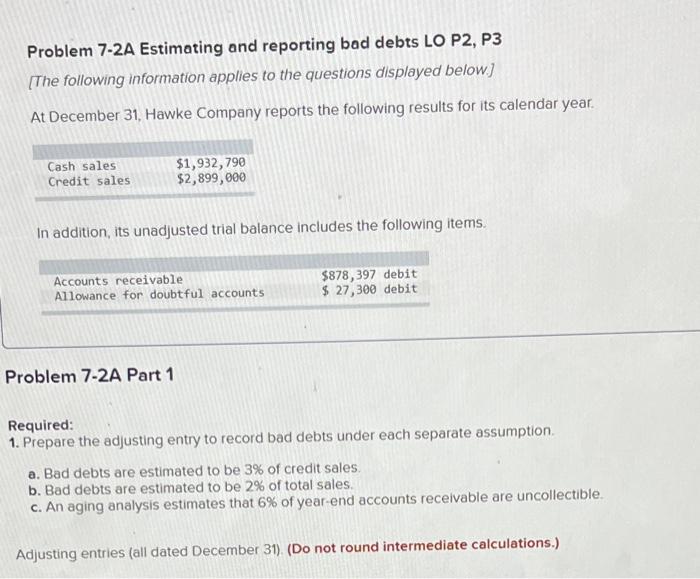

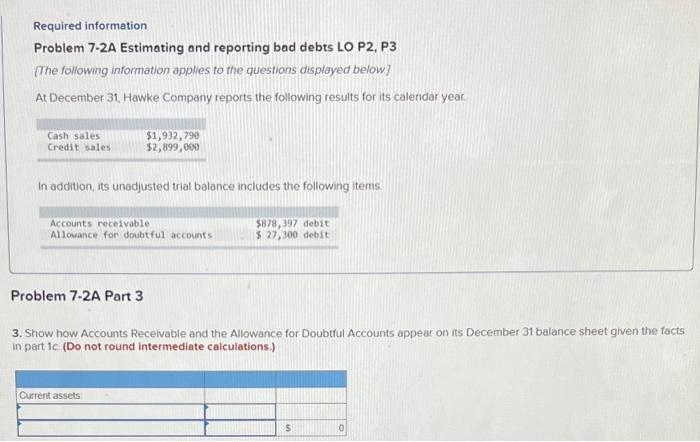

Question: Problem 7-2A Estimating and reporting bad debts LO P2, P3 [The following information applies to the questions displayed below.] At December 31 , Hawke Company

![following information applies to the questions displayed below.] At December 31 ,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e3220ccb7dd_42066e3220c66b45.jpg)

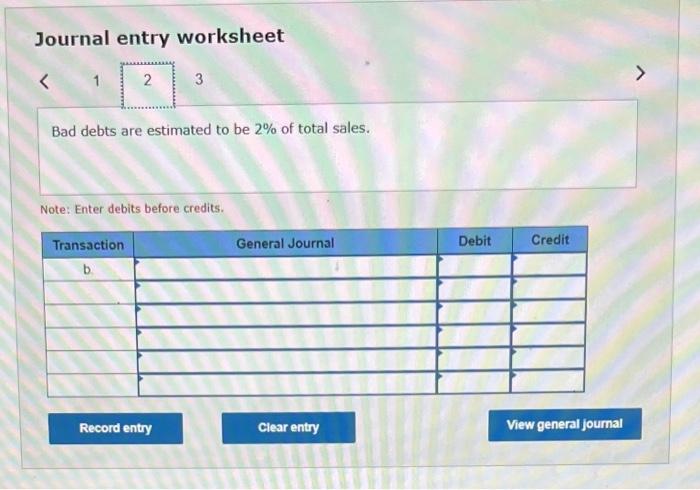

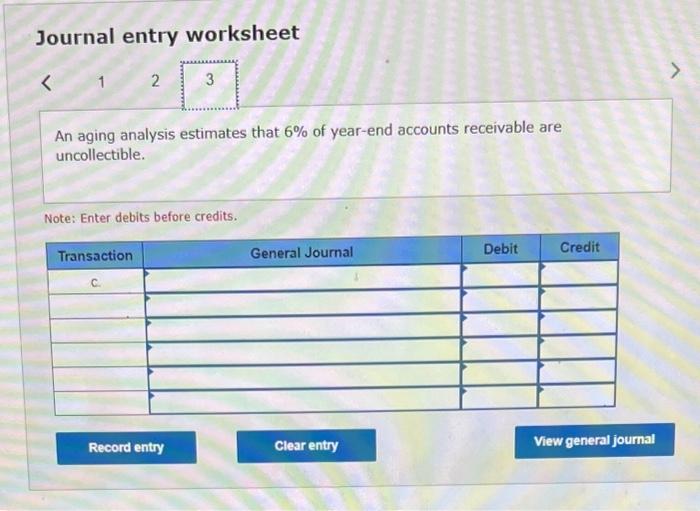

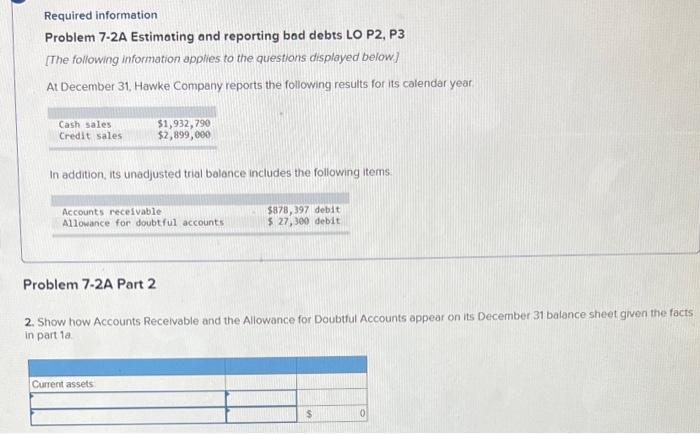

Problem 7-2A Estimating and reporting bad debts LO P2, P3 [The following information applies to the questions displayed below.] At December 31 , Hawke Company reports the following results for its calendar year. In addition, its unadjusted trial balance includes the following items. Problem 7-2A Part 1 Required: 1. Prepare the adjusting entry to record bad debts under each separate assumption. a. Bad debts are estimated to be 3% of credit sales. b. Bad debts are estimated to be 2% of total sales. c. An aging analysis estimates that 6% of year-end accounts receivable are uncollectible. Adjusting entries (all dated December 31). (Do not round intermediate calculations.) Journal entry worksheet Bad debts are estimated to be 3% of credit sales. Note: Enter debits before credits. Journal entry worksheet Bad debts are estimated to be 2% of total sales. Note: Enter debits before credits. Journal entry worksheet An aging analysis estimates that 6% of year-end accounts receivable are uncollectible. Note: Enter debits before credits. Required information Problem 7-2A Estimating and reporting bad debts LO P2, P3 [The following information applies to the questions displayed below] At December 31, Hawke Company reports the following results for its calendar yeat. In addition, its unadjusted trial balance includes the following items: Problem 7-2A Part 2 2. Show how Accounts Recelvable and the Allowance for Doubtful Accounts appear on its December 31 batance sheet given the facts in part 1a. Required information Problem 7-2A Estimating and reporting bad debts LO P2, P3 [The following information applies to the questions displayed below] At December 31. Hawke Company reports the following results for its calendar year. In addition, its unadjusted trial balance includes the following items. Problem 7-2A Part 3 3. Show how Accounts Recelvable and the Allowance for Doubtrul Accounts appear on its December 31 balance sheet given the facts in part 1c. (Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts