Question: Problem 7-37 (LO. 6) During 2020, Leisel, a single taxpayer, operates a sole proprietorship in which she materially participates. Her proprietorship generates gross income of

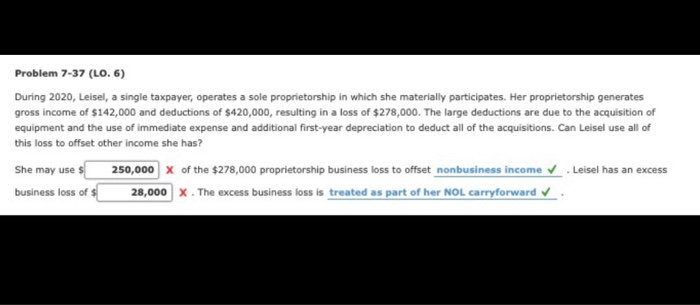

Problem 7-37 (LO. 6) During 2020, Leisel, a single taxpayer, operates a sole proprietorship in which she materially participates. Her proprietorship generates gross income of $142,000 and deductions of $420,000, resulting in a loss of $278,000. The large deductions are due to the acquisition of equipment and the use of immediate expense and additional first-year depreciation to deduct all of the acquisitions. Can Leisel use all of this loss to offset other income she has? She may use 250,000 X of the $278,000 proprietorship business loss to offset nonbusiness income Leisel has an excess business loss of $. 28,000 x. The excess business loss is treated as part of her NOL carryforward

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts