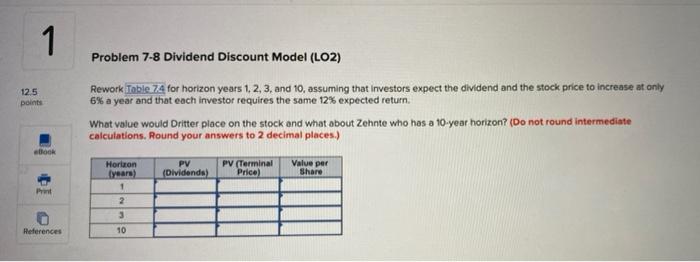

Question: Problem 7-8 Dividend Discount Model (LO2) 125 points Rework Table 74 for horizon years 1, 2, 3, and 10, assuming that investors expect the dividend

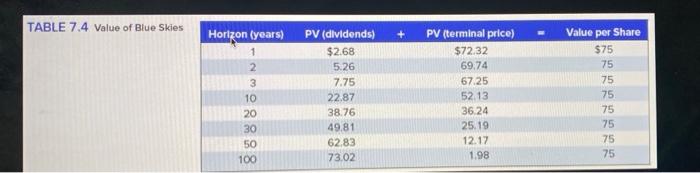

Problem 7-8 Dividend Discount Model (LO2) 125 points Rework Table 74 for horizon years 1, 2, 3, and 10, assuming that investors expect the dividend and the stock price to increase at only 6% a year and that each investor requires the same 12% expected return What value would Dritter place on the stock and what about Zehnte who has a 10-year horizon? (Do not round Intermediate calculations. Round your answers to 2 decimal places.) BOOK Horizon years) 1 PV (Dividends) PV (Terminal Price Value per Share Prat 2 3 References 10 TABLE 7.4 Value of Blue Skies Horizon (years) PV (dividends) + Value per Share 1 $75 $2.68 5.26 2 PV (terminal price) $72.32 69.74 67.25 52.13 75 3 7.75 75 10 20 30 75 75 36.24 22.87 38.76 49.81 62.83 73.02 75 50 25.19 12.17 1.98 75 75 100 Problem 7-8 Dividend Discount Model (LO2) 125 points Rework Table 74 for horizon years 1, 2, 3, and 10, assuming that investors expect the dividend and the stock price to increase at only 6% a year and that each investor requires the same 12% expected return What value would Dritter place on the stock and what about Zehnte who has a 10-year horizon? (Do not round Intermediate calculations. Round your answers to 2 decimal places.) BOOK Horizon years) 1 PV (Dividends) PV (Terminal Price Value per Share Prat 2 3 References 10 TABLE 7.4 Value of Blue Skies Horizon (years) PV (dividends) + Value per Share 1 $75 $2.68 5.26 2 PV (terminal price) $72.32 69.74 67.25 52.13 75 3 7.75 75 10 20 30 75 75 36.24 22.87 38.76 49.81 62.83 73.02 75 50 25.19 12.17 1.98 75 75 100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts