Question: Problem 8 - 4 ( Algo ) Various inventory transactions; determining inventory and cost of goods; LIFO reserve [ LO 8 - 1 , 8

Problem Algo Various inventory transactions; determining inventory and cost of goods; LIFO reserve LO

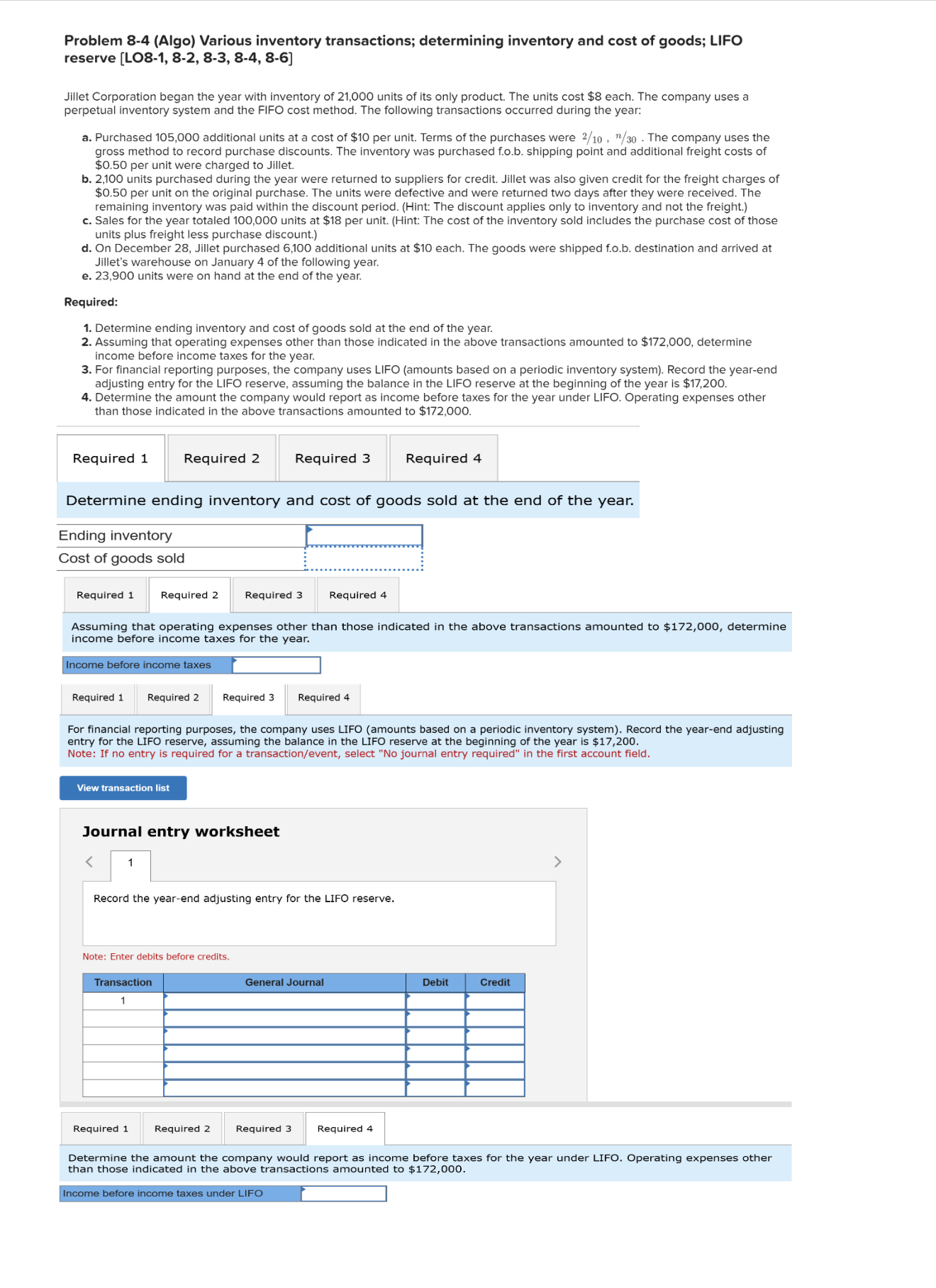

Jillet Corporation began the year with inventory of units of its only product. The units cost $ each. The company uses a perpetual inventory system and the FIFO cost method. The following transactions occurred during the year:

a Purchased additional units at a cost of $ per unit. Terms of the purchases were The company uses the gross method to record purchase discounts. The inventory was purchased fob shipping point and additional freight costs of $ per unit were charged to Jillet.

b units purchased during the year were returned to suppliers for credit. Jillet was also given credit for the freight charges of $ per unit on the original purchase. The units were defective and were returned two days after they were received. The remaining inventory was paid within the discount period. Hint: The discount applies only to inventory and not the freight.

c Sales for the year totaled units at $ per unit. Hint: The cost of the inventory sold includes the purchase cost of those units plus freight less purchase discount.

d On December Jillet purchased additional units at $ each. The goods were shipped fob destination and arrived at Jillet's warehouse on January of the following year.

e units were on hand at the end of the year.

Required:

Determine ending inventory and cost of goods sold at the end of the year.

Assuming that operating expenses other than those indicated in the above transactions amounted to $ determine income before income taxes for the year.

For financial reporting purposes, the company uses LIFO amounts based on a periodic inventory system Record the yearend adjusting entry for the LIFO reserve, assuming the balance in the LIFO reserve at the beginning of the year is $

Determine the amount the company would report as income before taxes for the year under LIFO. Operating expenses other than those indicated in the above transactions amounted to $

Required

Determine ending inventory and cost of goods sold at the end of the year.

tableEnding inventory,Cost of goods sold,

Assuming that operating expenses other than those indicated in the above transactions amounted to $ determine income before income taxes for the year.

Income before income taxes

For financial reporting purposes, the company uses LIFO amounts based on a periodic inventory system Record the yearend adjusting entry for the LIFO reserve, assuming the balance in the LIFO reserve at the beginning of the year is $

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

Journal entry worksheet

Record the yearend adjusting entry for the LIFO reserve.

Note: Enter debits before credits.

tableTransactionGeneral Journal,Debit,Credit

Required

Determine the amount the company would report as income before taxes for the year under LIFO. Operating expenses other than those indicated in the above transactions amounted to $

Income before income taxes under LIFO

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock