Question: Problem 8 - 5 1 ( LO . 7 ) Martha was considering starting a new business. During her preliminary investigations related to the new

Problem LO

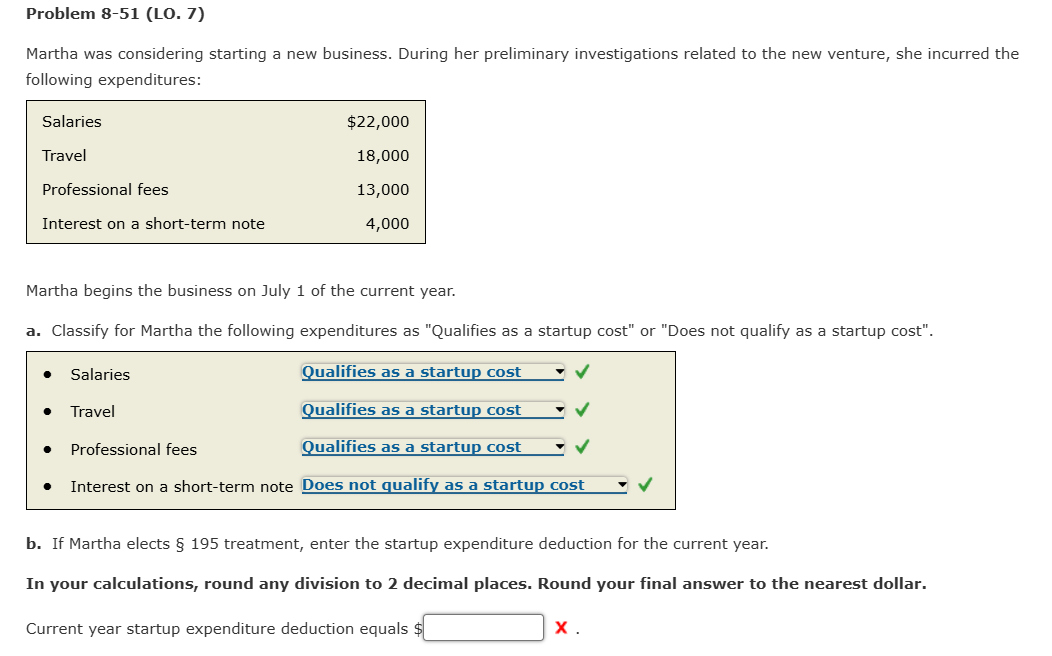

Martha was considering starting a new business. During her preliminary investigations related to the new venture, she incurred the following expenditures:

Salaries$TravelProfessional feesInterest on a shortterm note

Martha begins the business on July of the current year.

aClassify for Martha the following expenditures as "Qualifies as a startup cost" or "Does not qualify as a startup cost".

Salaries

Qualifies as a startup cost Does not qualify as a startup costQualifies as a startup cost

Travel

Qualifies as a startup costDoes not qualify as a startup costQualifies as a startup cost

Professional fees

Qualifies as a startup costDoes not qualify as a startup costQualifies as a startup cost

Interest on a shortterm note

Qualifies as a startup costDoes not qualify as a startup costDoes not qualify as a startup cost

bIf Martha elects treatment, enter the startup expenditure deduction for the current year.

In your calculations, round any division to decimal places. Round your final answer to the nearest dollar.

Current year startup expenditure deduction equals $fill in the blank Problem LO

Martha was considering starting a new business. During her preliminary investigations related to the new venture, she incurred the following expenditures:

Martha begins the business on July of the current year.

a Classify for Martha the following expenditures as "Qualifies as a startup cost" or "Does not qualify as a startup cost".

b If Martha elects S treatment, enter the startup expenditure deduction for the current year.

In your calculations, round any division to mathbf decimal places. Round your final answer to the nearest dollar.

Current year startup expenditure deduction equals $ X

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock