Question: Problem 8-55 (LO. 7) Martha was considering starting a new business. During her preliminary investigations related to the new venture, she incurred the following expenditures:

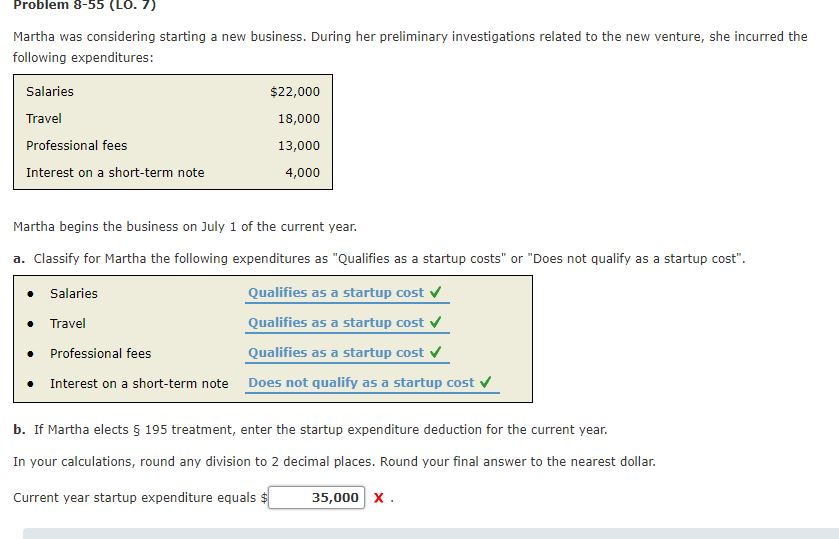

Problem 8-55 (LO. 7) Martha was considering starting a new business. During her preliminary investigations related to the new venture, she incurred the following expenditures: Salaries Travel Professional fees Interest on a short-term note $22,000 18,000 13,000 4,000 Martha begins the business on July 1 of the current year a. Classify for Martha the following expenditures as "Qualifies as a startup costs" or "Does not qualify as a startup cost. Qualifies as a startup cost v Qualifies as a startup cost v Qualifies as a startup cost v Does not qualify as a startup cost v Salaries Travel . Professional fees . Interest on a short-term note b. If Martha elects 195 treatment, enter the startup expenditure deduction for the current year. In your calculations, round any division to 2 decimal places. Round your final answer to the nearest dollar Current year startup expenditure equals $ 35,000 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts