Question: problem 8 a,b, and c Chapter 13 Decision Analysis of the operation depends on future demand. The annoncesto of dollars depends on demand as follows:

problem 8 a,b, and c

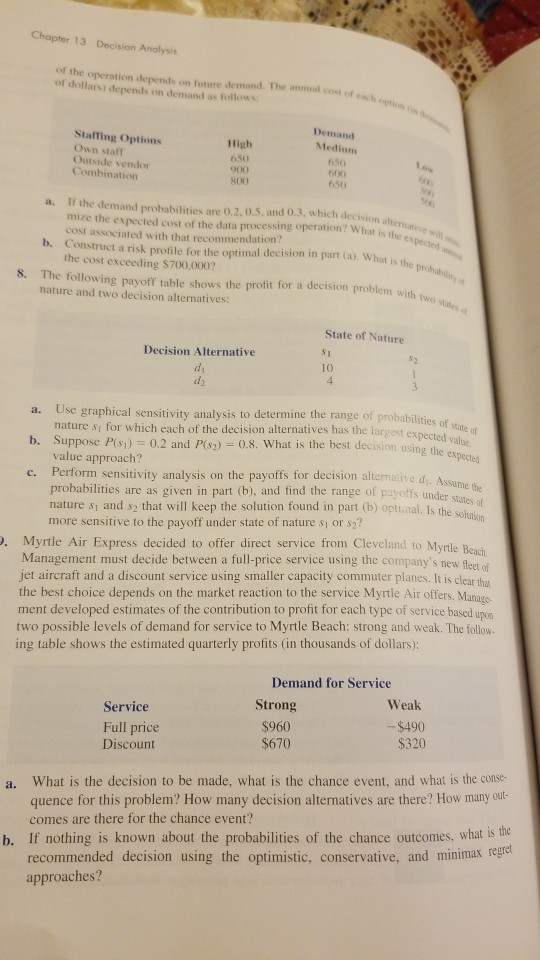

Chapter 13 Decision Analysis of the operation depends on future demand. The annoncesto of dollars depends on demand as follows: Stating Options Ownstant Outside vendor Combination Demand Medium 6.50 000 800 650 a. Ir the demand probabilities are 0.2.0.5. and 0.3, which decision mize the expected cost of the data processing operation? What is the cost associated with that recommendation! b. Construct a risk profile for the optimal decision in part (a). What is the cost exceeding $700,000? The following pavofl table shows the profit for a decision problem with nature and two decision alternatives: 8. State of Nature Decision Alternative SI 10 babilities of State of be largest expected value using the expected Val ed. Assume the a. Use graphical sensitivity analysis to determine the range of probabilities natures for which each of the decision alternatives has the largest expert b. Suppose P(s) = 0.2 and P(82) = 0.8. What is the best decision using the value approach? c. Perform sensitivity analysis on the payoffs for decision alternative di Assum probabilities are as given in part (b), and find the range of payoffs under sta natures, and s2 that will keep the solution found in part (b) optimal. Is the more sensitive to the payoff under state of nature si or ? 2. Myrtle Air Express decided to offer direct service from Cleveland to Myrtle Be Management must decide between a full-price service using the company's new fleet of jet aircraft and a discount service using smaller capacity commuter planes. It is clear tha the best choice depends on the market reaction to the service Myrtle Air offers. Manage ment developed estimates of the contribution to profit for each type of service based upon two possible levels of demand for service to Myrtle Beach: strong and weak. The follow ing table shows the estimated quarterly profits (in thousands of dollars): Service Full price Discount Demand for Service Strong Weak $960 -$490 $670 $320 a. What is the decision to be made, what is the chance event, and what is the conse- quence for this problem? How many decision alternatives are there? How many out- comes are there for the chance event? If nothing is known about the probabilities of the chance outcomes, what is me recommended decision using the optimistic, conservative, and minimax regre approaches? bStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock