Question: Problem 8. Consider the two-period binomial model with u = 2, d = 1/2 and interest rate r = 1/6 and suppose that S0 =

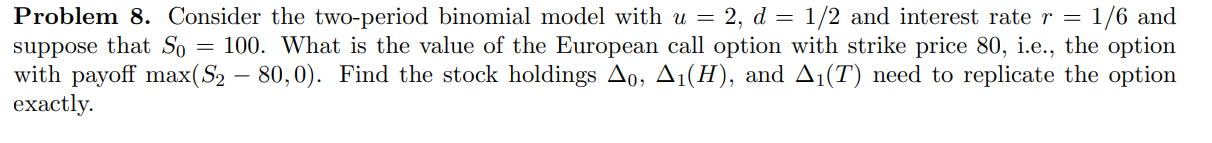

Problem 8. Consider the two-period binomial model with u = 2, d = 1/2 and interest rate r = 1/6 and suppose that S0 = 100. What is the value of the European call option with strike price 80, i.e., the option with payoff max(S2 80, 0). Find the stock holdings 0, 1(H), and 1(T) need to replicate the option exactly.

Problem 8. Consider the two-period binomial model with u = 2, d = 1/2 and interest rate r = 1/6 and suppose that S0 = 100. What is the value of the European call option with strike price 80, i.e., the option with payoff max(S2 80, 0). Find the stock holdings 0, 1(H), and 1(T) need to replicate the option exactly.

Problem 8. Consider the two-period binomial model with u = 2, d = 1/2 and interest rate r = 1/6 and suppose that So = 100. What is the value of the European call option with strike price 80, i.e., the option with payoff max(S2 80,0). Find the stock holdings A0, A1(H), and A1(T) need to replicate the option exactly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts