Question: Problem 8-13 Mod fied Accelerated Cost Recovery 5 ystem (MACRS), Election wo Expense (L0 8.2, 8.3) Tom has a successful business with $100,000 of taxable

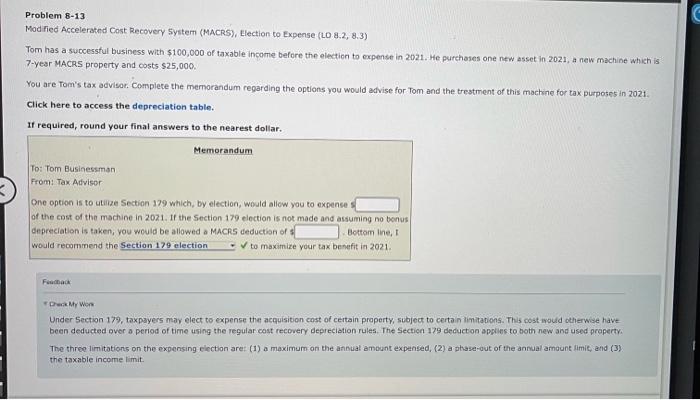

Problem 8-13 Mod fied Accelerated Cost Recovery 5 ystem (MACRS), Election wo Expense (L0 8.2, 8.3) Tom has a successful business with $100,000 of taxable income before the electicn to expense in 2021. He purchases one new asset in 2021 , a new machine which is 7 -year MACRS property and costs $25,000. You are Tom's tax advisor. Complete the memorandum regarding the options you would advise for Tom and the trestment of this machine for tax purposes in 2021. Click here to access the depreciation table. If required, round your final answers to the nearest dollar. Fsuonack T preck Mtr wors Under Section 179, taxpayers may elect to expense the acquisition cost of certain praperty, subject to certan limitations. This cost mould otherwse have been deducted over a period of time using the regular cost recovery depreciation rules. The Secticn 179 deducton applies to both new and used property. The three limitations on the expensing election are: (1) a maximum on the annual amount expensed, (2) a phase-aut of the ansual amount limit; and (3) the taxable income limit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts