Question: Problem 8-28 You are choosing between two projects, but can only take one. The cash flows for the projects are given in the table below:

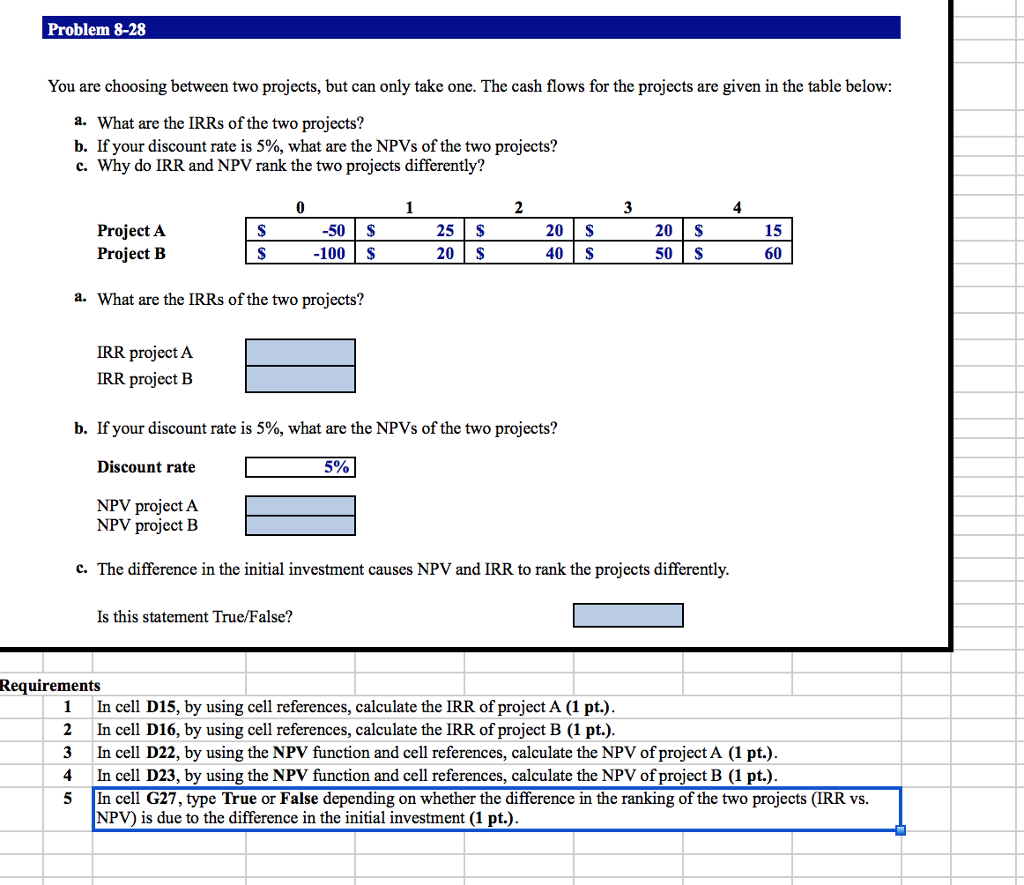

Problem 8-28 You are choosing between two projects, but can only take one. The cash flows for the projects are given in the table below: a. What are the IRRs of the two projects? b. If your discount rate is 5%, what are the NPVs of the two projects? c. Why do IRR and NPV rank the two projects differently? 4 Project A Project B 50 S -100 S 25$ 20S 20 S 40 S 20 S 50 S 15 60 a. What are the IRRs of the two projects? IRR project A IRR project B b. If your discount rate is 5%, what are the NPVs of the two projects? Discount rate 5% NPV project A NPV project B c. The difference in the initial investment causes NPV and IRR to rank the projects differently. Is this statement True/False? Requirements 1In cell D15, by using cell references, calculate the IRR of project A (1 pt.) 2In cell D16, by using cell references, calculate the IRR of project B (1 pt.) 3In cell D22, by using the NPV function and cell references, calculate the NPV of project A (1 pt.) 4In cell D23, by using the NPV function and cell references, calculate the NPV of project B (1 pt.) 5 In cell G27, type True or False depending on whether the difference in the ranking of the two projects (IRR vs. NPV) is due to the difference in the initial investment (1 pt.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts