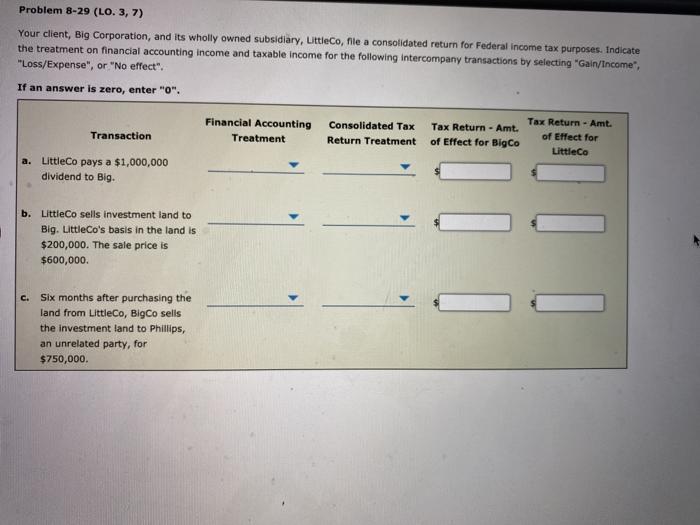

Question: Problem 8-29 (LO. 3,7) Your client, Big Corporation, and its wholly owned subsidiary, LittleCo, file a consolidated return for Federal income tax purposes. Indicate the

Problem 8-29 (LO. 3,7) Your client, Big Corporation, and its wholly owned subsidiary, LittleCo, file a consolidated return for Federal income tax purposes. Indicate the treatment on financial accounting income and taxable income for the following Intercompany transactions by selecting "Gain/Income", "Loss/Expense", or "No effect". If an answer is zero, enter "0". Tax Return - Amt. Financial Accounting Consolidated Tax Tax Return - Amt. of Effect for Transaction Treatment Return Treatment of Effect for Bigco LittleCa a. LittleCo pays a $1,000,000 dividend to Big. 1 b. LittleCo sells investment and to Big LittleCo's basis in the land is $200,000. The sale price is $600,000 111 111 c. Six months after purchasing the land from LittleCo, BigCo sells the investment and to Phillips, an unrelated party, for $750,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts