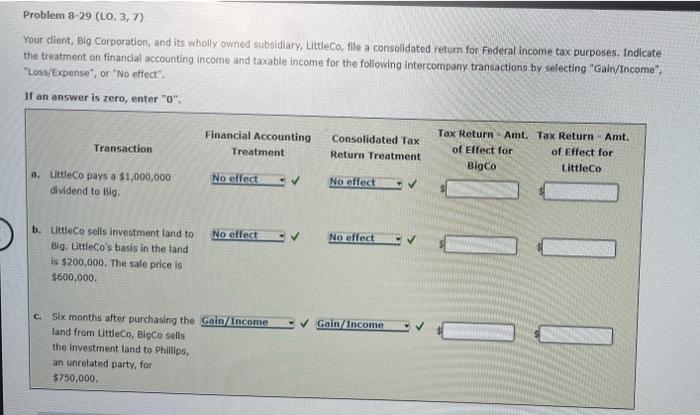

Question: Problem 8-29 (LO. 3,7) Your client, Big Corporation, and its wholly owned subsidiary, LittleCo, file a consolidated return for Federal income tax purposes. Indicate the

Problem 8-29 (LO. 3,7) Your client, Big Corporation, and its wholly owned subsidiary, LittleCo, file a consolidated return for Federal income tax purposes. Indicate the treatment on financial accounting income and taxable income for the following intercompany transactions by selecting "Gain/Income", "Loss/Expense", or "No effect". If an answer is zero, enter "o". Financial Accounting Treatment Transaction Consolidated Tax Return Treatment Tax Return Amt. Tax Return Amt. of Effect for of Effect for Bigco Littleco a littleco pays a $1,000,000 dividend to Big No effect No effect No effect No effect b. LittleCo sells investment and to Bio, LittleCo's basis in the land is $200,000. The sale price is $600,000 DO 11 Gain Income c. Six months after purchasing the Gain/Income land from Littleco, BigCo sells the investment and to Phillips, an unrelated party, for $750,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts