Question: Problem 8-30A Calculating depreciation expense using four different methods LO 8-2, 8-3, 8-4, 8-6 Banko Inc. manufactures sporting goods. The following information applies to a

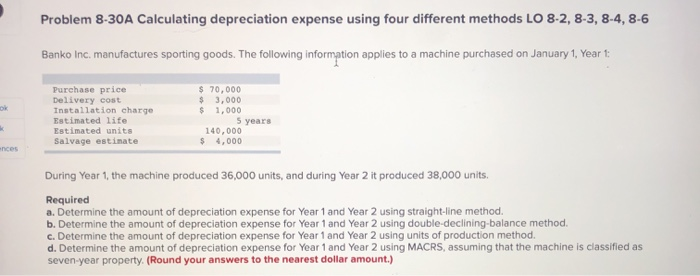

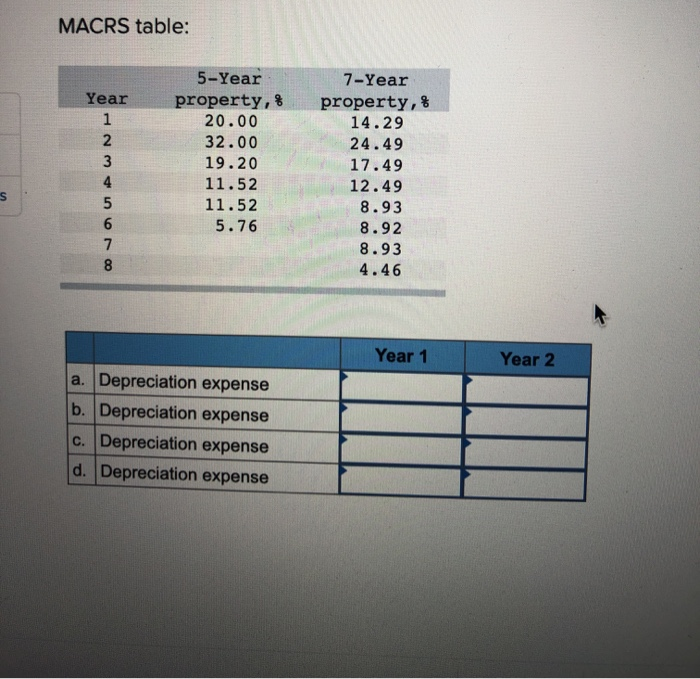

Problem 8-30A Calculating depreciation expense using four different methods LO 8-2, 8-3, 8-4, 8-6 Banko Inc. manufactures sporting goods. The following information applies to a machine purchased on January 1, Year 1: Purchase price Delivery cost Installation charge Estimated life Estimated units Salvage estimate $ 70,000 $ 3,000 $ 1,000 5 years 140.000 $ 4,000 During Year 1, the machine produced 36,000 units, and during Year 2 it produced 38,000 units. Required a. Determine the amount of depreciation expense for Year 1 and Year 2 using straight-line method. b. Determine the amount of depreciation expense for Year 1 and Year 2 using double-declining-balance method. c. Determine the amount of depreciation expense for Year 1 and Year 2 using units of production method. d. Determine the amount of depreciation expense for Year 1 and Year 2 using MACRS, assuming that the machine is classified as seven-year property. (Round your answers to the nearest dollar amount.) MACRS table: Year 5-Year property,% 20.00 32.00 19.20 11.52 11.52 5.76 7-Year property,% 14.29 24.49 17.49 12.49 8.93 8.92 8.93 4.46 Year 1 Year 2 a. Depreciation expense b. Depreciation expense c. Depreciation expense d. Depreciation expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts