Question: i could really use help with this question thank you Problem 8-30A (Static) Calculating depreciation expense using four different methods LO 8-2, 8-3, 8-4, 8-6

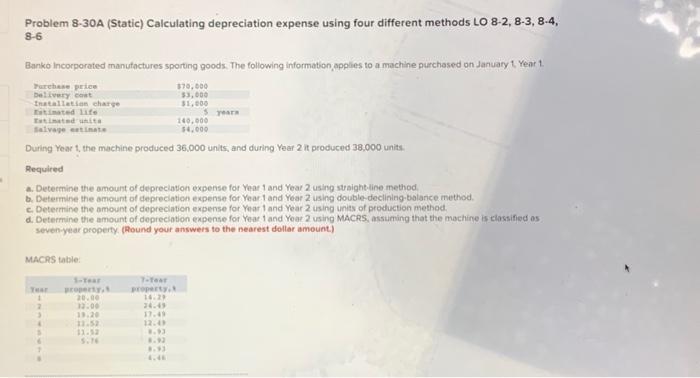

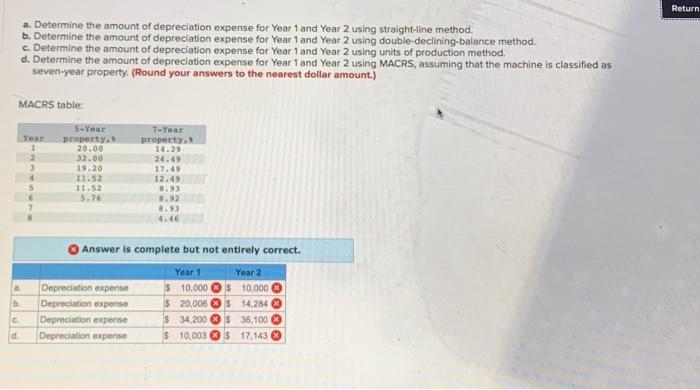

Problem 8-30A (Static) Calculating depreciation expense using four different methods LO 8-2, 8-3, 8-4, 8-6 Banko incorporated manufactures sporting goods. The following information, applies to a machine purchased on January 1 Year 1. During Year t, the machine produced 36,000 units, and during Year 2 it produced 38,000 units. Required a. Determine the amount of depreciation expense for Year 1 and Year 2 using ituaightine method. b. Determine the amount of depreciation expense for Year 1 and Year 2 using double-declining-balance method. c. Deternine the amount of deprecintion expense for Year 1 and Year 2 using units of production method. d. Determine the emount of deprecintion expense for Year 1 and Yoar 2 wing MACDS assuining that the machine is classified os seven-year property. (Alound your answers to the nearest dollar amount) MACRS tabie: a. Determine the amount of depreciation expense for Year 1 and Year 2 using straight-line method. b. Determine the amount of depreciation expense for Year 1 and Year 2 using double-declining-balance method. c. Determine the amount of depreciation expense for Year 1 and Year 2 using units of production method. d. Determine the amount of depreciation expense for Year 1 and Year 2 using MACRS, assuming that the machine is classified as seven-year property. (Round your answers to the nearest dollar amount.) MACRS table: Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts