Question: Problem 8-48 (a) (LO. 2, 4) On February 2, 2018, Katie purchased and placed in service a new $18,500 car. The car was used 65%

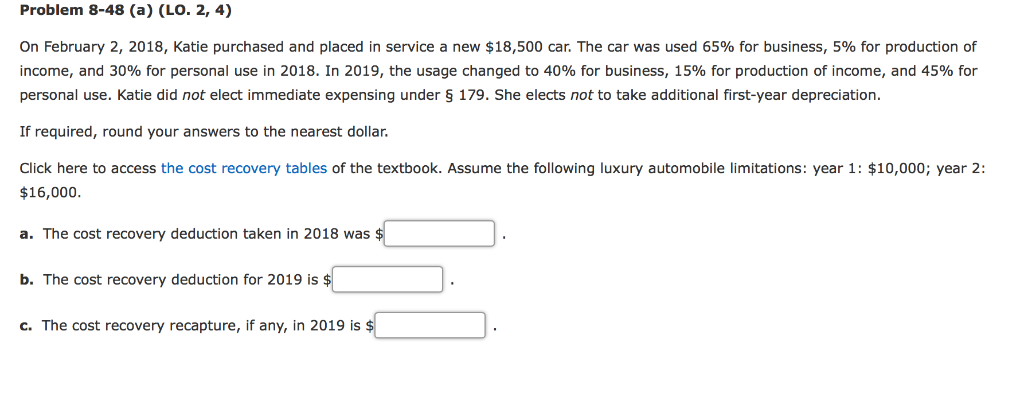

Problem 8-48 (a) (LO. 2, 4) On February 2, 2018, Katie purchased and placed in service a new $18,500 car. The car was used 65% for business, 596 for production of income, and 30% for personal use in 2018, In 2019, the usage changed to 40% for business, 15% for production of income, and 45% for personal use. Katie did not elect immediate expensing under 179. She elects not to take additional first-year depreciation. If required, round your answers to the nearest dollar. Click here to access the cost recovery tables of the textbook. Assume the following luxury automobile limitations: year 1: $10,000; year 2: $16,000 a. The cost recovery deduction taken in 2018 was b. The cost recovery deduction for 2019 is c. The cost recovery recapture, if any, in 2019 is Problem 8-48 (a) (LO. 2, 4) On February 2, 2018, Katie purchased and placed in service a new $18,500 car. The car was used 65% for business, 596 for production of income, and 30% for personal use in 2018, In 2019, the usage changed to 40% for business, 15% for production of income, and 45% for personal use. Katie did not elect immediate expensing under 179. She elects not to take additional first-year depreciation. If required, round your answers to the nearest dollar. Click here to access the cost recovery tables of the textbook. Assume the following luxury automobile limitations: year 1: $10,000; year 2: $16,000 a. The cost recovery deduction taken in 2018 was b. The cost recovery deduction for 2019 is c. The cost recovery recapture, if any, in 2019 is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts