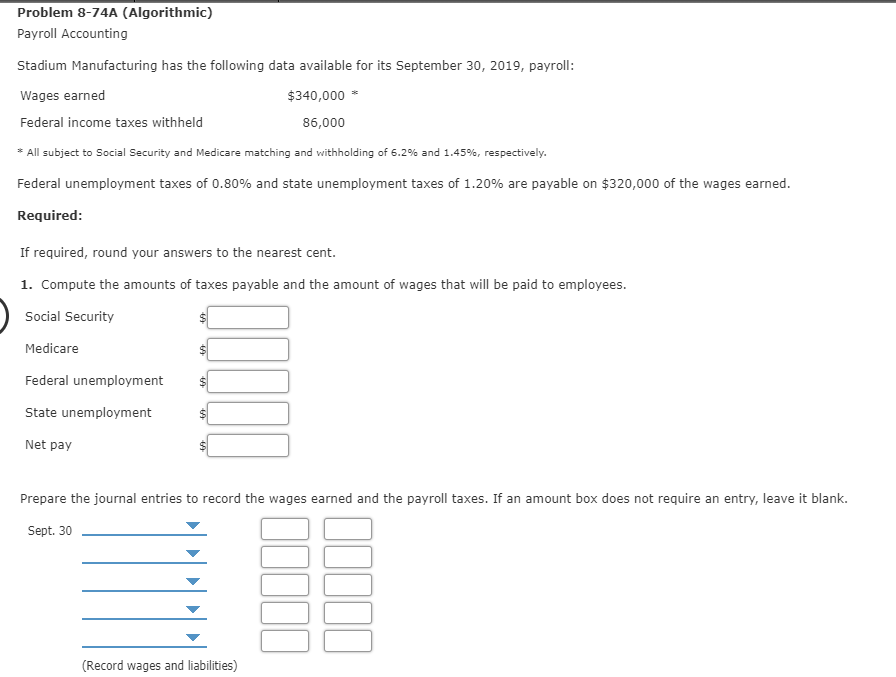

Question: Problem 8-74A (Algorithmic) Payroll Accounting Stadium Manufacturing has the following data available for its September 30, 2019, payroll Wages earned Federal income taxes withheld *

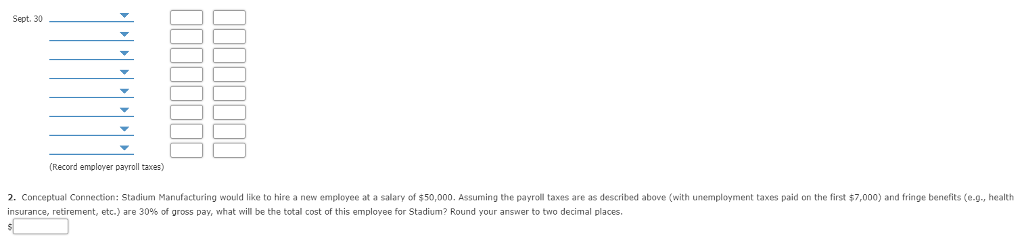

Problem 8-74A (Algorithmic) Payroll Accounting Stadium Manufacturing has the following data available for its September 30, 2019, payroll Wages earned Federal income taxes withheld * All subject to Social Security and Medicare matching and withholding of 6.2% and 1.45%, respectively Federal unemployment taxes of 0.80% and state unemployment taxes of 1.20% are payable on $320,000 of the wages earned. Required: If required, round your answers to the nearest cent. 1. Compute the amounts of taxes payable and the amount of wages that will be paid to employees. Social Security $340,000 86,000 Medicare Federal unemployment State unemployment Net pay Prepare the journal entries to record the wages earned and the payroll taxes. If an amount box does not require an entryleave it blank. Sept. 30 Record wages and liabilities)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts