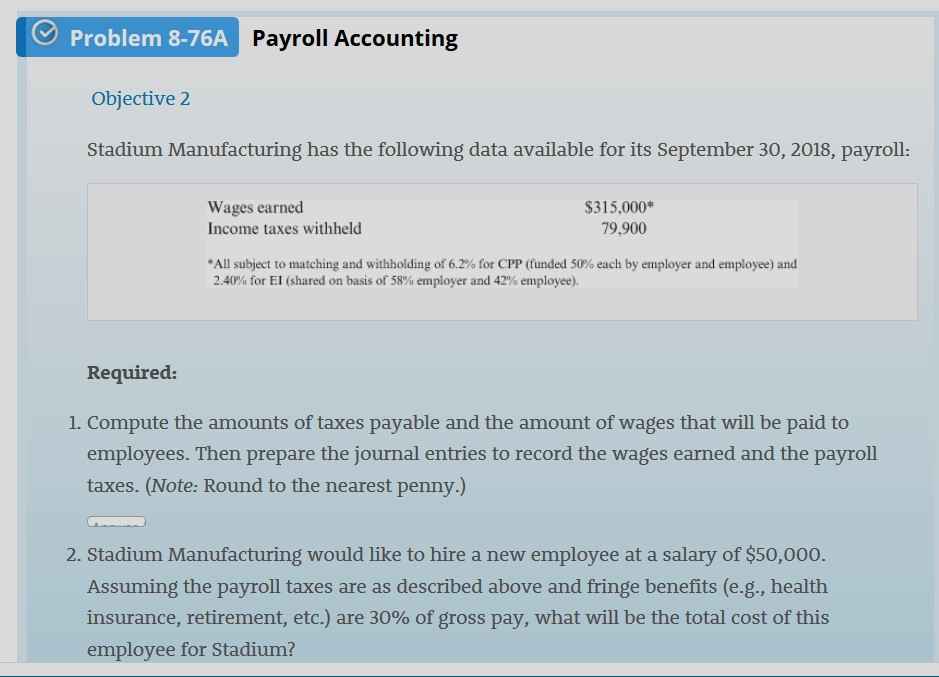

Question: Problem 8-76A Payroll Accounting Objective 2 Stadium Manufacturing has the following data available for its September 30, 2018, payroll: Wages earned Income taxes withheld $315,000*

Problem 8-76A Payroll Accounting Objective 2 Stadium Manufacturing has the following data available for its September 30, 2018, payroll: Wages earned Income taxes withheld $315,000* 79,900 *All subject to matching and withholding of 6.2% for CPP (funded 50% each by employer and employee) and 2.40% for El (shared on basis of 58% employer and 42% employee). Required: 1. Compute the amounts of taxes payable and the amount of wages that will be paid to employees. Then prepare the journal entries to record the wages earned and the payroll taxes. (Note: Round to the nearest penny.) 2. Stadium Manufacturing would like to hire a new employee at a salary of $50,000. Assuming the payroll taxes are as described above and fringe benefits (e.g., health insurance, retirement, etc.) are 30% of gross pay, what will be the total cost of this employee for Stadium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts