Question: Question 4 (1pt) Which of the following is not an assumption of the CAPM? (A) Investors will form the same expectations about the average

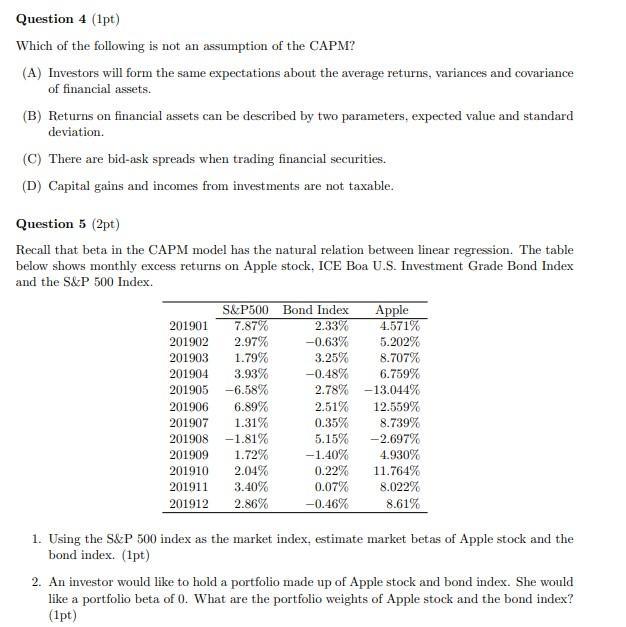

Question 4 (1pt) Which of the following is not an assumption of the CAPM? (A) Investors will form the same expectations about the average returns, variances and covariance of financial assets. (B) Returns on financial assets can be described by two parameters, expected value and standard deviation. (C) There are bid-ask spreads when trading financial securities. (D) Capital gains and incomes from investments are not taxable. Question 5 (2pt) Recall that beta in the CAPM model has the natural relation between linear regression. The table below shows monthly excess returns on Apple stock. ICE Boa U.S. Investment Grade Bond Index and the S&P 500 Index. S&P500 7.87% 201901 201902 2.97% 201903 1.79% 201904 3.93% 201905 -6.58% 201906 6.89% 201907 1.31% 201908 -1.81% 201909 1.72% 201910 2.04% 201911 3.40% 201912 2.86% Bond Index 2.33% -0.63% 3.25% Apple 0.07% -0.46% 4.571% 5.202% 8.707% 6.759% -0.48% 2.78% -13.044% 2.51% 12.559% 0.35% 8.739% 5.15% -2.697% -1.40% 4.930% 0.22% 11.764% 8.022% 8.61% 1. Using the S&P 500 index as the market index. estimate market betas of Apple stock and the bond index. (1pt) 2. An investor would like to hold a portfolio made up of Apple stock and bond index. She would like a portfolio beta of 0. What are the portfolio weights of Apple stock and the bond index? (1pt)

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below 1 Beta for Apple stock Beta can be calculated using the linear regression equation Beta C... View full answer

Get step-by-step solutions from verified subject matter experts