Question: Problem 8.9.26. (Correlation coefficient implied from the price of a maximum claim) Assume the Black-Scholes framework. Consider two nondividend-paying stocks whose time-t prices are denoted

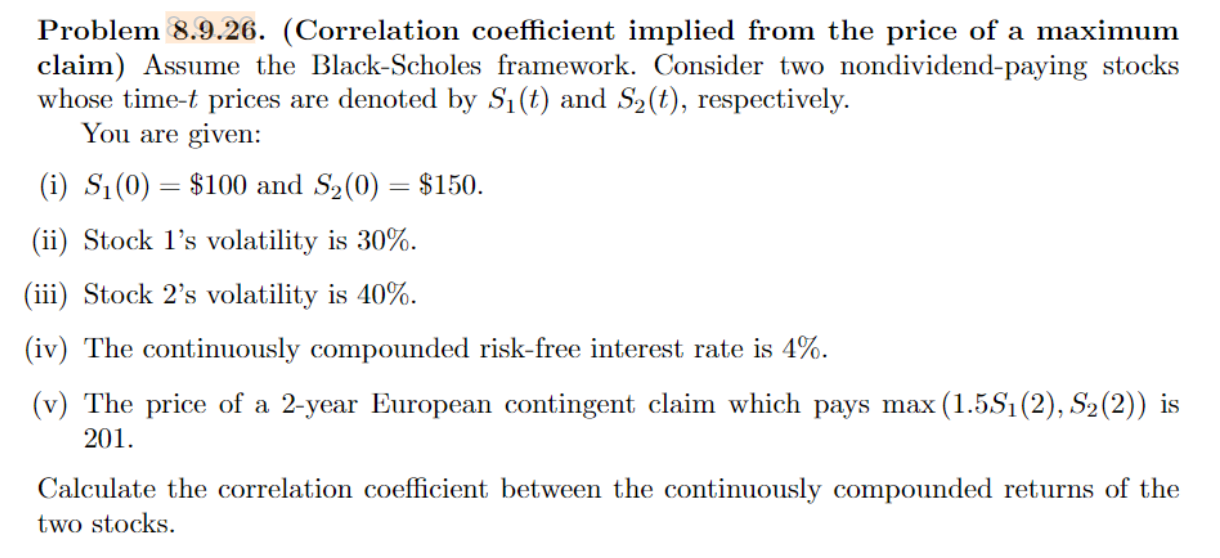

Problem 8.9.26. (Correlation coefficient implied from the price of a maximum claim) Assume the Black-Scholes framework. Consider two nondividend-paying stocks whose time-t prices are denoted by Si(t) and S2(t), respectively. You are given: (i) S (0) = $100 and S2(0) = $150. (ii) Stock l's volatility is 30%. (iii) Stock 2's volatility is 40%. (iv) The continuously compounded risk-free interest rate is 4%. (v) The price of a 2-year European contingent claim which pays max (1.5S (2), S2(2)) is 201. Calculate the correlation coefficient between the continuously compounded returns of the two stocks. Problem 8.9.26. (Correlation coefficient implied from the price of a maximum claim) Assume the Black-Scholes framework. Consider two nondividend-paying stocks whose time-t prices are denoted by Si(t) and S2(t), respectively. You are given: (i) S (0) = $100 and S2(0) = $150. (ii) Stock l's volatility is 30%. (iii) Stock 2's volatility is 40%. (iv) The continuously compounded risk-free interest rate is 4%. (v) The price of a 2-year European contingent claim which pays max (1.5S (2), S2(2)) is 201. Calculate the correlation coefficient between the continuously compounded returns of the two stocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts