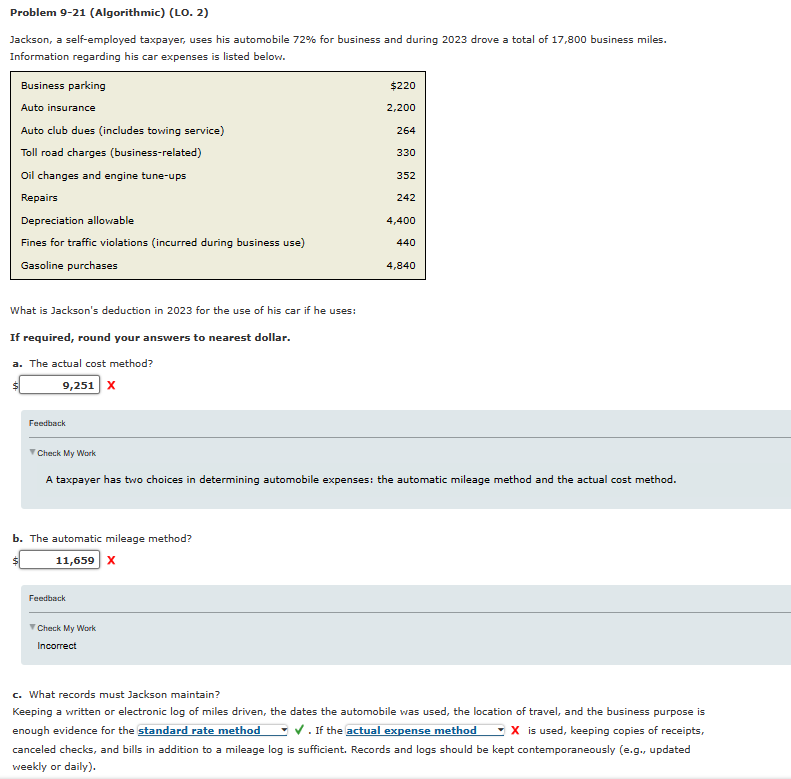

Question: Problem 9 - 2 1 ( Algorithmic ) ( LO . 2 ) Jackson, a self - employed taxpayer, uses his automobile 7 2 %

Problem AlgorithmicLO

Jackson, a selfemployed taxpayer, uses his automobile for business and during drove a total of business miles.

Information regarding his car expenses is listed below.

Business parking

What is Jackson's deduction in for the use of his car if he uses:

If required, round your answers to nearest dollar.

a The actual cost method?

$

Auto insurance

Auto club dues includes towing service

Toll road charges businessrelated

Oil changes and engine tuneups

Repairs

Depreciation allowable

Fines for traffic violations incurred during business use

Gasoline purchases

Feedback

Check My Work

A taxpayer has two choices in determining automobile expenses: the automatic mileage method and the actual cost method.

b The automatic mileage method?

Feedback

Check My Work

Incorrect

c What records must Jackson maintain?

Keeping a written or electronic log of miles driven, the dates the automobile was used, the location of travel, and the business purpose is

enough evidence for the standard rate method If the actual expense method is used, keeping copies of receipts,

canceled checks, and bills in addition to a mileage log is sufficient. Records and logs should be kept contemporaneously eg updated

weekly or daily

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock