Question: Problem 9 - 4 4 Saved Part 5 of 9 believes that Intercoastal needs to keep a minimum cash balance of $ 1 5 ,

Problem

Saved

Part of

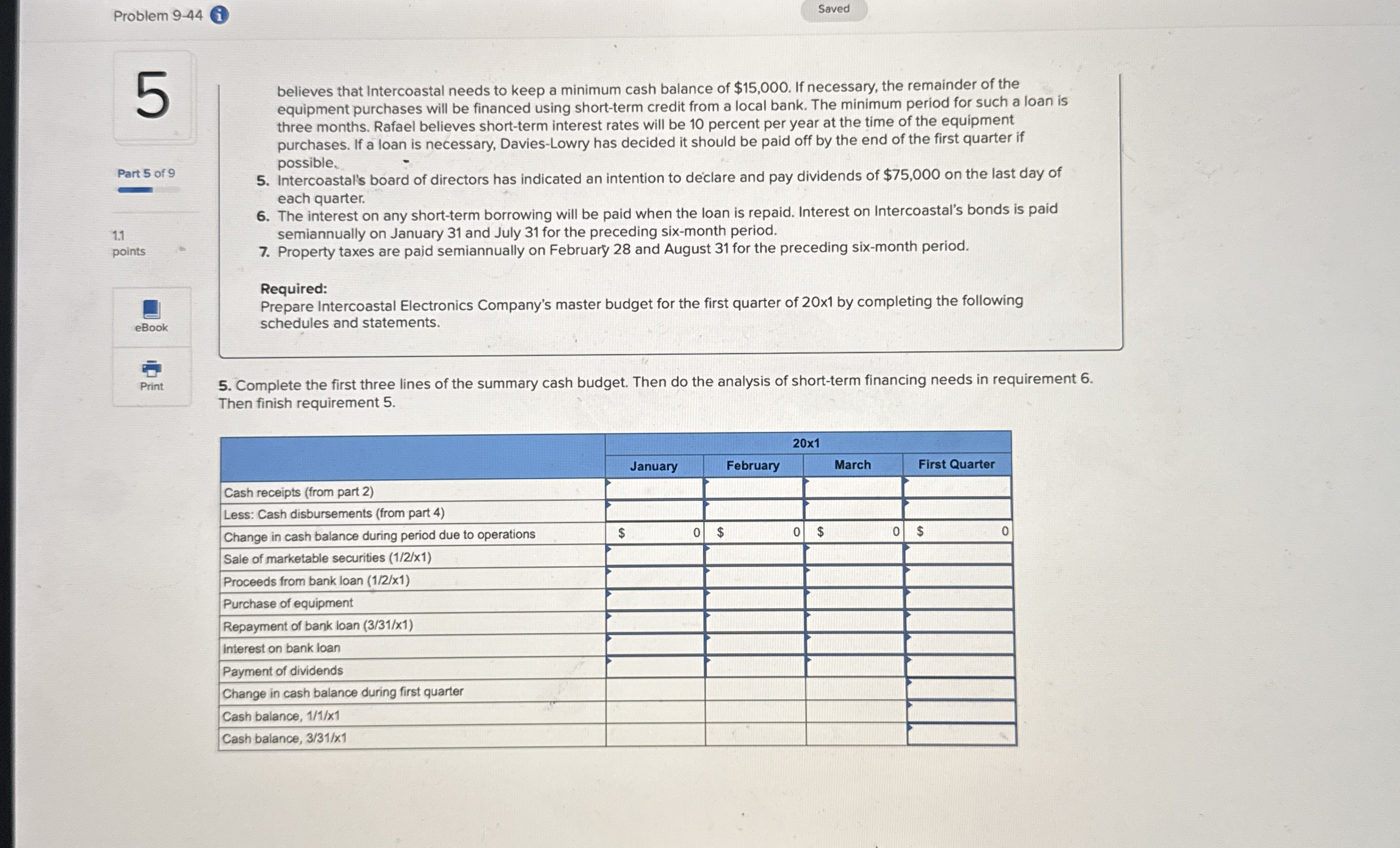

believes that Intercoastal needs to keep a minimum cash balance of $ If necessary, the remainder of the equipment purchases will be financed using shortterm credit from a local bank. The minimum period for such a loan is three months. Rafael believes shortterm interest rates will be percent per year at the time of the equipment purchases. If a loan is necessary, DaviesLowry has decided it should be paid off by the end of the first quarter if possible.

Intercoastal's board of directors has indicated an intention to declare and pay dividends of $ on the last day of each quarter.

The interest on any shortterm borrowing will be paid when the loan is repaid. Interest on Intercoastal's bonds is paid semiannually on January and July for the preceding sixmonth period.

Property taxes are paid semiannually on February and August for the preceding sixmonth period.

Required:

Prepare Intercoastal Electronics Company's master budget for the first quarter of by completing the following schedules and statements.

Complete the first three lines of the summary cash budget. Then do the analysis of shortterm financing needs in requirement Then finish requirement

table

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock