Question: Problem 9-28 (Algorithmic) (LO. 2) On July 1, 2017, Brent purchases a new automobile for $44,500. He uses the car 90% for business and

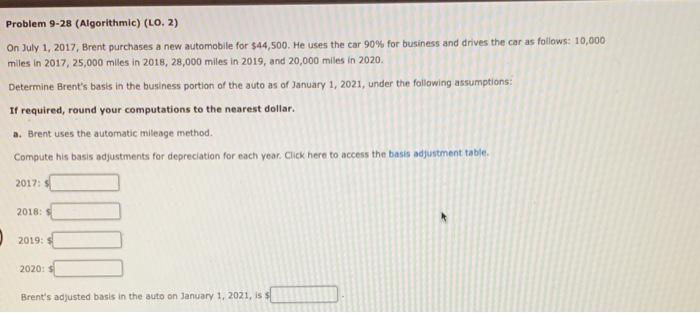

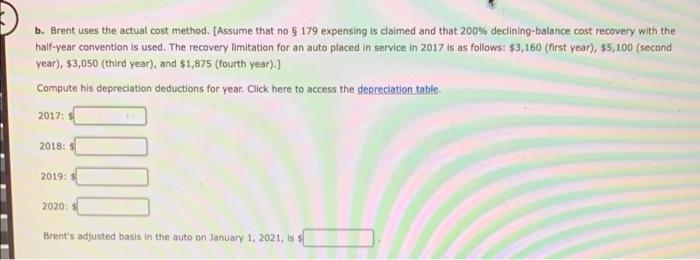

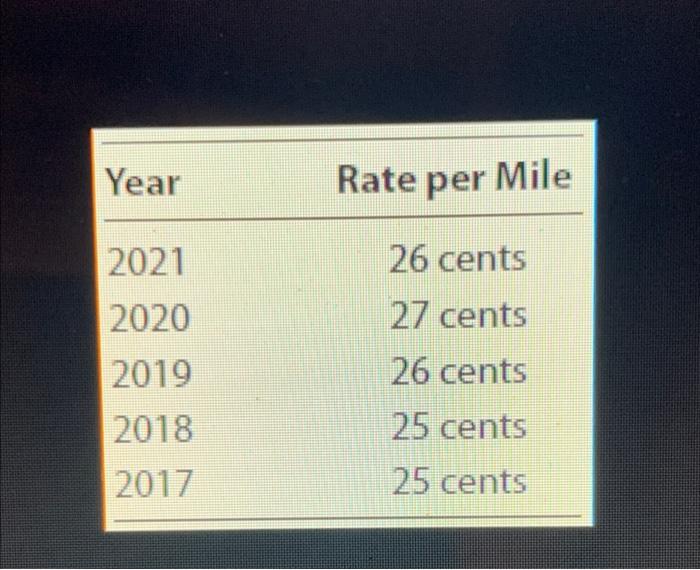

Problem 9-28 (Algorithmic) (LO. 2) On July 1, 2017, Brent purchases a new automobile for $44,500. He uses the car 90% for business and drives the car as follows: 10,000 miles in 2017, 25,000 miles in 2018, 28,000 miles in 2019, and 20,000 miles in 2020. Determine Brent's basis in the business portion of the auto as of January 1, 2021, under the following assumptions: If required, round your computations to the nearest dollar. a. Brent uses the automatic mileage method. Compute his basis adjustments for depreciation for each year. Click here to access the basis adjustment table. 2017: 2018: 2019: $ 2020: $ Brent's adjusted basis in the auto on January 1, 2021, is s

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts