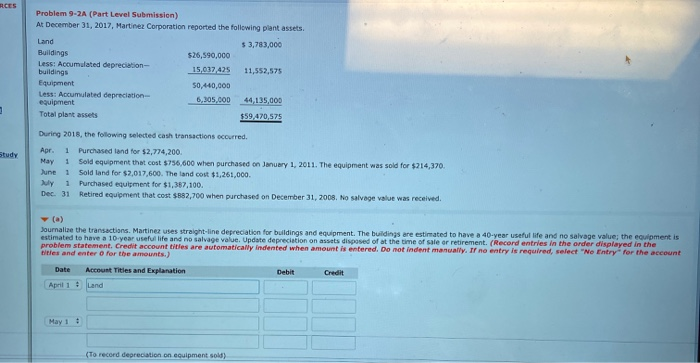

Question: Problem 9-2A (Part Level Submission) At December 31, 2017 Martinez Corporation reported the following plant assets $ 3,783,000 11,552,575 Land Buildings Less: Accumulated depreciation- buildings

Problem 9-2A (Part Level Submission) At December 31, 2017 Martinez Corporation reported the following plant assets $ 3,783,000 11,552,575 Land Buildings Less: Accumulated depreciation- buildings Equipment Less: Accumulated depreciation equipment Total plant assets $26,590,000 15,017 475 50,440,000 6.305.000 44,135,000 $59,470,575 During 2018, the following selected cash transactions occurred. Apr. 1 Purchased and for $2,774,200 May 1 Sold equipment that cost $756,600 when purchased on January 1, 2011. The equipment was sold for $214,370 June 1 Sold land for $2,017,600. The land cout $1,261,000. MY 1 Purchased equipment for $1,387,100. Dec. 31 Retired equipment that cost $82,700 when purchased on December 31, 2008. No salvage value was received (a) Journal the transactions Martine uses s i n depreciation for buildings and equipment. The buildings we estimated to have a 40-year useful and no salvage value; the equipment is estimated to have a 10 year stude and no salvage valge Update depreciation on assets disposed of the time of sale or retirement. (Record entries in the order displayed in the problem statement Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "Ne Entry for the account tities and enter for the amounts.) Date Account Tities and Explanation Debit Credit (April 1 Lond (To record depreciation on equipment sold) d. If the union negotiated wage Wu, what is t Why? Fotiated wage Wu, what is the highest level of employment it could negotiate? e. What point represents the competitive lab represents the competitive labor market (non-union) wage and employment combination

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts