Question: Problem 9-33 Risk, Return, and Their Relationship (LG3, LG4) Consider the following annual returns of Estee Lauder and Lowe's Companies: Year 1 Year 2 Year

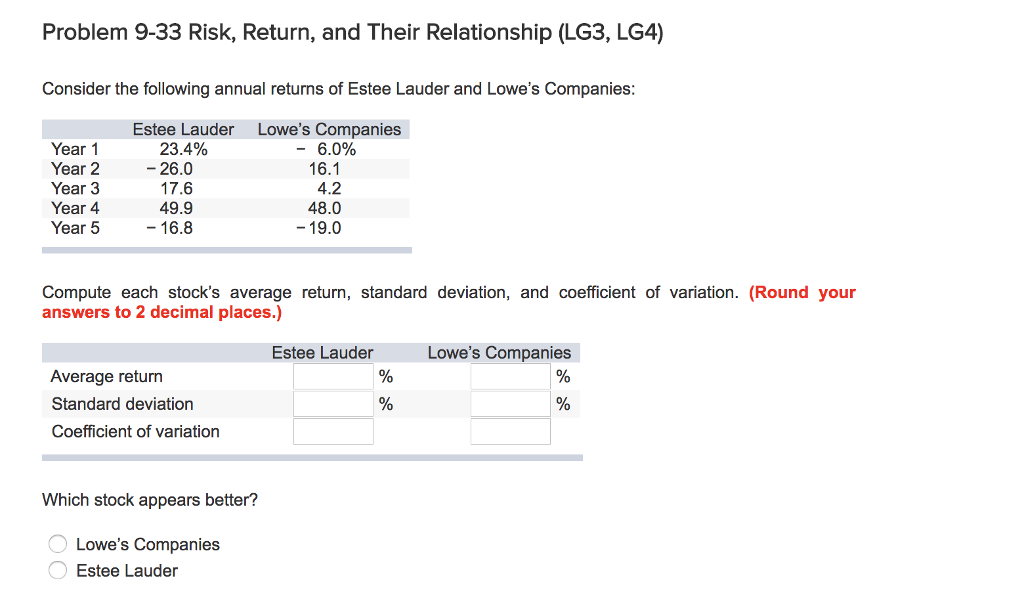

Problem 9-33 Risk, Return, and Their Relationship (LG3, LG4) Consider the following annual returns of Estee Lauder and Lowe's Companies: Year 1 Year 2 Year 3 Year 4 Year 5 Estee Lauder 23.4% - 26.0 17.6 Lowe's Companies - 6.0% 16.1 4.2 48.0 - 19.0 49.9 - 16.8 Compute each stock's average return, standard deviation, and coefficient of variation. (Round your answers to 2 decimal places.) Estee Lauder Lowe's Companies Average return Standard deviation Coefficient of variation % % Which stock appears better? O Lowe's Companies O Estee Lauder

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts