Question: Problem 9-6 Estimated Payments (LO 9.2) Kana is a single wage earner with no dependents and taxable income of $168,700 in 2020. Her 2019 taxable

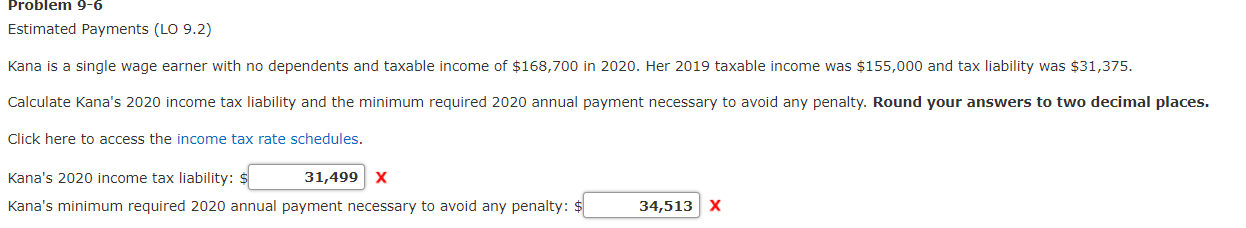

Problem 9-6 Estimated Payments (LO 9.2) Kana is a single wage earner with no dependents and taxable income of $168,700 in 2020. Her 2019 taxable income was $155,000 and tax liability was $31,375. Calculate Kana's 2020 income tax liability and the minimum required 2020 annual payment necessary to avoid any penalty. Round your answers to two decimal places. Click here to access the income tax rate schedules. Kana's 2020 income tax liability: $ 31,499 x Kana's minimum required 2020 annual payment necessary to avoid any penalty: $ 34,513 X

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock