Question: Problem 9.9 Calculating NPV and IRR (LO1, 5] A project that provides annual cash flows of $18,200 for nine years costs $88,000 today. What is

![Problem 9.9 Calculating NPV and IRR (LO1, 5] A project that](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ed73f1760f3_74466ed73f0d5790.jpg)

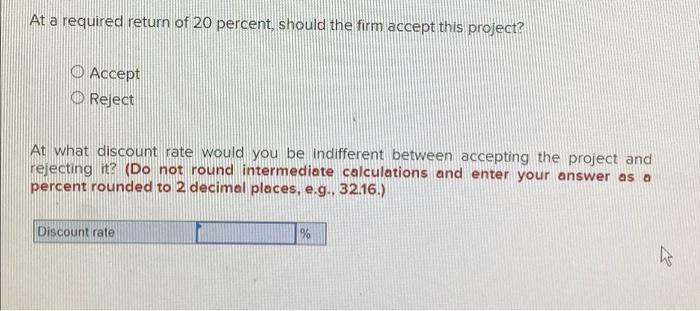

Problem 9.9 Calculating NPV and IRR (LO1, 5] A project that provides annual cash flows of $18,200 for nine years costs $88,000 today. What is the NPV for the project if the required return is 8 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV At a required return of 8 percent, should the firm accept this project? OAccept O Reject What is the NPV for the project if the required return is 20 percent? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g. 32.16.) NPV At a required return of 20 percent, should the firm accept this project? O Accept Reject At what discount rate would you be indifferent between accepting the project and rejecting it? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g. 32.16.) Discount rate %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts