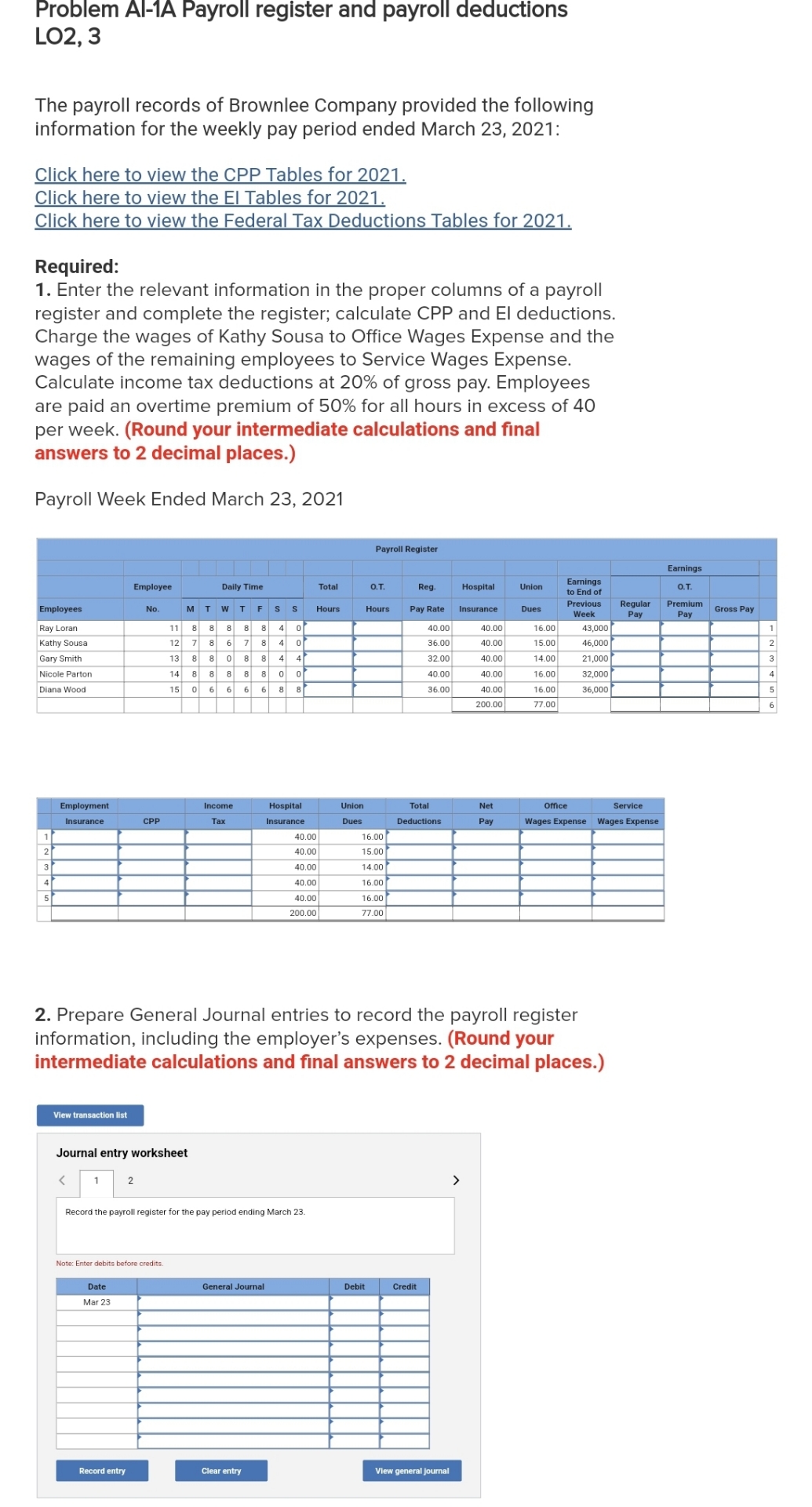

Question: Problem A - 1 A Payroll register and payroll deductionsLO 2 , 3 The payroll records of Brownlee Company provided the followinginformation for the weekly

Problem AA Payroll register and payroll deductionsLOThe payroll records of Brownlee Company provided the followinginformation for the weekly pay period ended March :Click here to view the CPP Tables for Click here to view the El Tables for Click here to view the Federal Tax Deductions Tables for Required: Enter the relevant information in the proper columns of a payrollregister and complete the register; calculate CPP and El deductions.Charge the wages of Kathy Sousa to Office Wages Expense and thewages of the remaining employees to Service Wages Expense.Calculate income tax deductions at of gross pay. Employeesare paid an overtime premium of for all hours in excess of per week. Round your intermediate calculations and finalanswers to decimal places.Payroll Week Ended March EmployeesRay LoranKathy SousaGary SmithNicole PartonDiana WoodEmploymentInsuranceView tran saction listEmployeeDateNoMar CPPRecord entryNote: Enter debits before creditsDaily TimeMT WJournal entry worksheetTFSSIncomeTax o Clear entry o oGeneral JournalHospitalInsuranceRecord the payroll register for the pay period ending March TotalHoursUnionDuesPayroll RegisterTHoursDebitReg.Pay RateCreditTotalDeductionsHospitalView general journalInsuranceNetPavUnionDues Prepare General Journal entries to record the payroll registerinformation, including the employer's expenses. Round yourintermediate calculations and final answers to decimal places.Earningsto End ofPreviousOfficeSRegulaServiceWages Expense Wages ExpenseEarningsPremium Gross Pay

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock