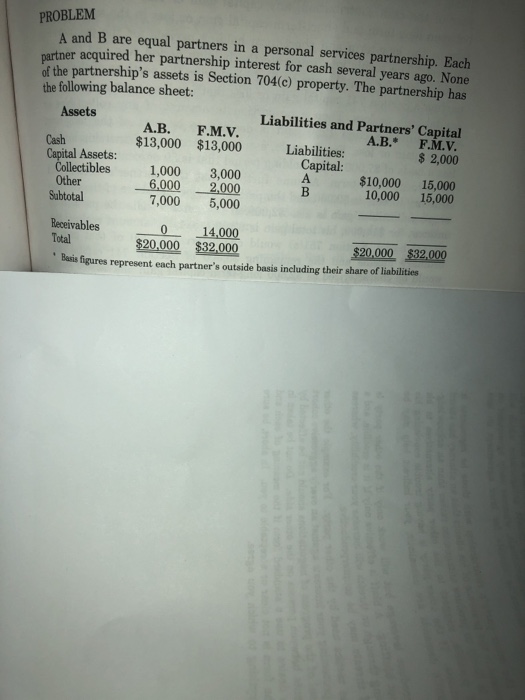

Question: PROBLEM A and B are equal partners in a personal services partnership. Each r acquired her partnership interest for cash several years ago. None of

PROBLEM A and B are equal partners in a personal services partnership. Each r acquired her partnership interest for cash several years ago. None of the partnership's assets is Section 704(c) property. The partnership has the following balance sheet: Liabilities and Partners' Capital A.B.* F.M.V. $2,000 Assets ?.?. F.M.V $13,000 $13,000 1,000 3,000 7,000 5,000 Receivables 0 14,000 Liabilities: Capital Cash Assets: Collectibles Other Subtotal $10,000 15,000 10,000 15,000 Total 0,000 $32,000 Basis figures represent each partner's outside basis including their share of liabilities PROBLEM A and B are equal partners in a personal services partnership. Each r acquired her partnership interest for cash several years ago. None of the partnership's assets is Section 704(c) property. The partnership has the following balance sheet: Liabilities and Partners' Capital A.B.* F.M.V. $2,000 Assets ?.?. F.M.V $13,000 $13,000 1,000 3,000 7,000 5,000 Receivables 0 14,000 Liabilities: Capital Cash Assets: Collectibles Other Subtotal $10,000 15,000 10,000 15,000 Total 0,000 $32,000 Basis figures represent each partner's outside basis including their share of liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts