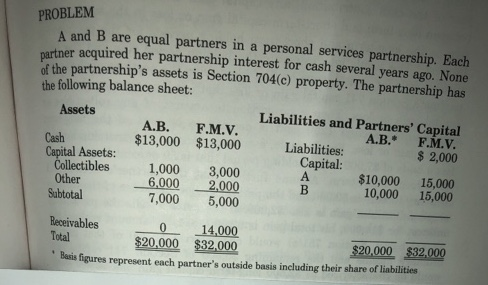

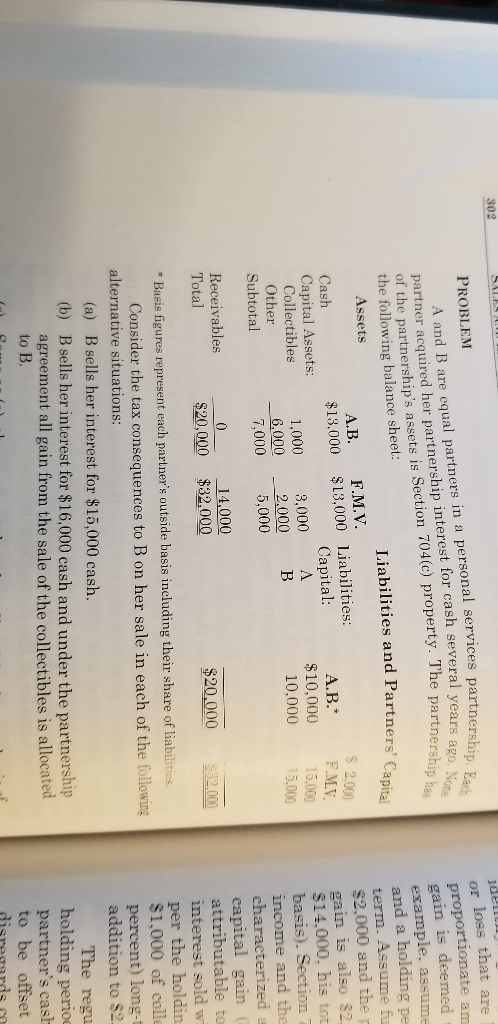

Question: PROBLEM and B are equal partners in a personal services partnership. Each er acquired her partnership interest for cash several years ago. None partnership's assets

PROBLEM and B are equal partners in a personal services partnership. Each er acquired her partnership interest for cash several years ago. None partnership's assets is Section 704(c) property. The partnership has of the the following balance sheet: Assets .. F.M.V. $13,000 $13,000 Liabilities and Partners' Capital A.B. F.M.V 2,000 Cash Capital Assets Liabilities Capital Collectibles Other 1,000 3,000 000 2,000 7,000 5,000 $10,000 15,000 10,000 15,000 Subtotal Receivables 0 14,000 $20,000 $32,000 Total Basis igures represent each partner's outside basis including their share of liabilities bi pd C 23 poi nat ea as t ple 0 to Td eh gl bpAB s hf aso peo I 1C 325 rie fo fo fr ree e ea 167 qes tan ntoee hhe Bueg ptull La rpoe PROBLEM and B are equal partners in a personal services partnership. Each er acquired her partnership interest for cash several years ago. None partnership's assets is Section 704(c) property. The partnership has of the the following balance sheet: Assets .. F.M.V. $13,000 $13,000 Liabilities and Partners' Capital A.B. F.M.V 2,000 Cash Capital Assets Liabilities Capital Collectibles Other 1,000 3,000 000 2,000 7,000 5,000 $10,000 15,000 10,000 15,000 Subtotal Receivables 0 14,000 $20,000 $32,000 Total Basis igures represent each partner's outside basis including their share of liabilities bi pd C 23 poi nat ea as t ple 0 to Td eh gl bpAB s hf aso peo I 1C 325 rie fo fo fr ree e ea 167 qes tan ntoee hhe Bueg ptull La rpoe

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts