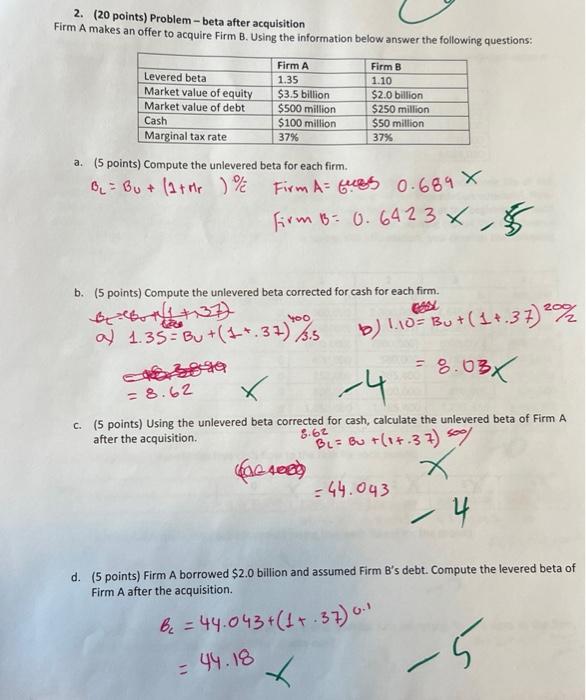

Question: Problem - beta after acquisition Firm A makes an offer to acquire Firm B. Using the information below answer the following questions: Levered beta Market

Problem - beta after acquisition Firm A makes an offer to acquire Firm B. Using the information below answer the following questions: Levered beta Market value of equity Market value of debt Cash Marginal tax rate a. Compute the unlevered beta for each firm. B = Bu + (1 + Mr ) % Firm A 1.35 $3.5 billion $500 million $100 million 37% 483849 b. Compute the unlevered beta corrected for cash for each firm. Be=B+1+137) you a) 1.35 = Bu + (1+. 37) //3.3 = 8.62 Firm A= 0.689 X Firm B: 0.6423 X Firm B 1.10 $2.0 billion $250 million $50 million 37% (ac seed) b) 1.10 = Bu + (1+.37) 20% 8.03X x -4 c. (5 points) Using the unlevered beta corrected for cash, calculate the unlevered beta of Firm A after the acquisition. 8.62 B = BU + (1+. 37) 500/ X -4 = = 44.043 $ 5,400 d. (5 points) Firm A borrowed $2.0 billion and assumed Firm B's debt. Compute the levered beta of Firm A after the acquisition. B = 44.043+ (1+.37) 0.1 = 44.18 -5

2. (20 points) Problem - beta after acquisition Firm A makes an offer to acquire Firm B. Using the information below answer the following questions: a. (5 points) Compute the unlevered beta for each firm. BL=Bv+(1+Ar)%FirmA=Gues0.689xFirmB=0.6423x3 b. (5 points) Compute the unlevered beta corrected for cash for each firm. =8.62x4=8.03x c. (5 points) Using the unlevered beta corrected for cash, calculate the unlevered beta of Firm A after the acquisition. =44.043 4 d. (5 points) Firm A borrowed $2.0 billion and assumed Firm B's debt. Compute the levered beta of Firm A after the acquisition

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock