Question: PROBLEM Chapter 7 Problems PR 7-1A FIFO perpetual inventory The beginning inventory at Funky Party Supplies and data on purchases and sales for a three-month

PROBLEM

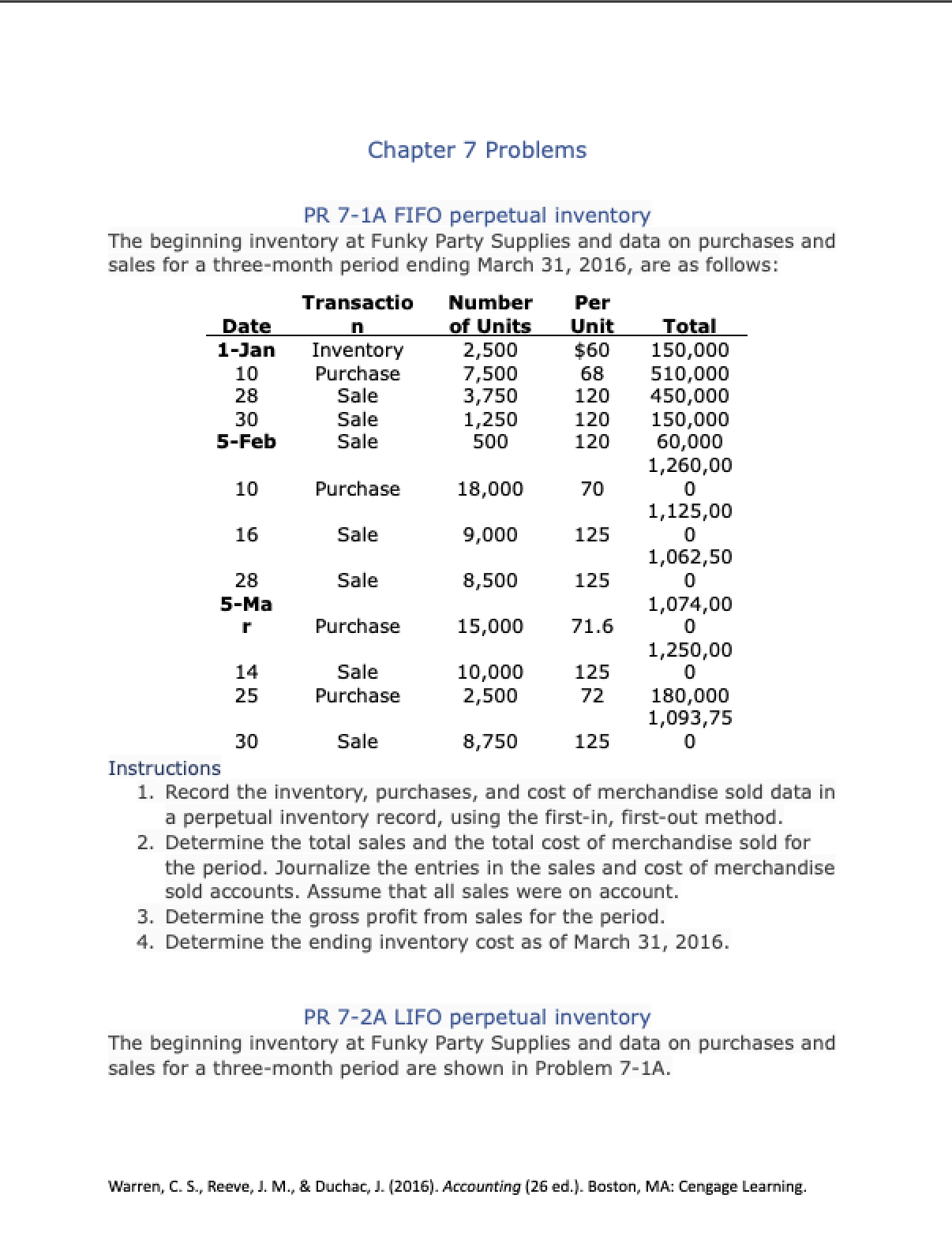

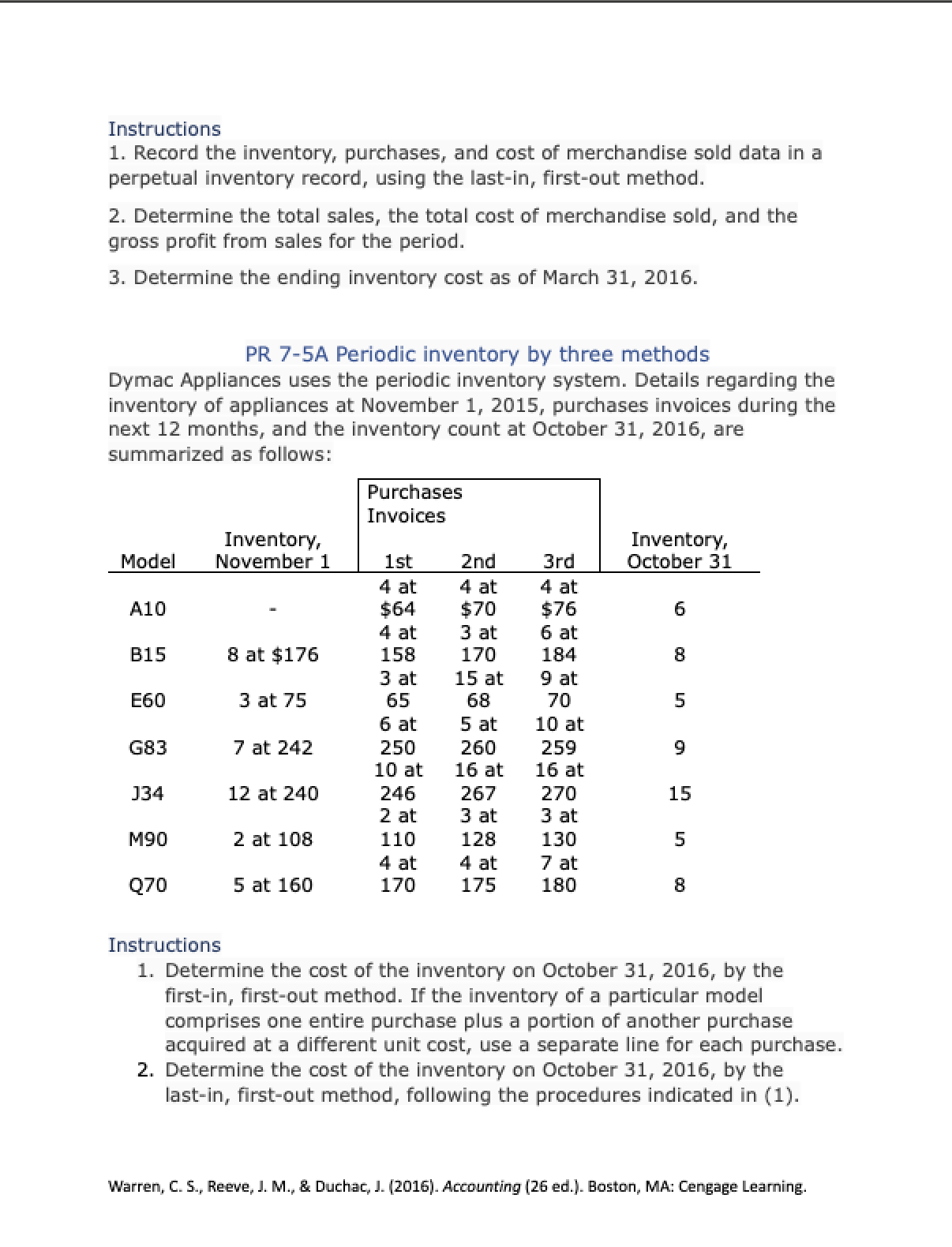

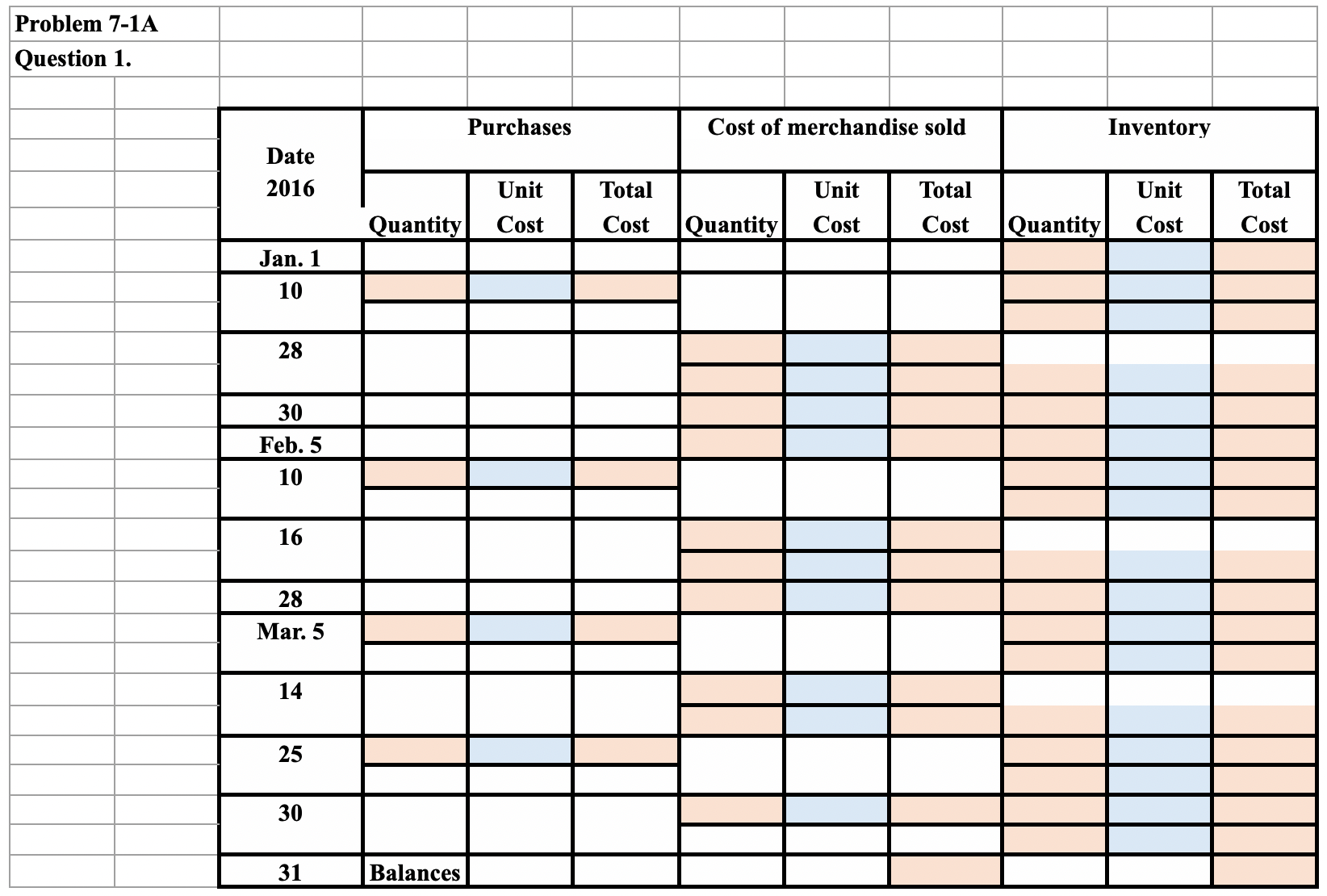

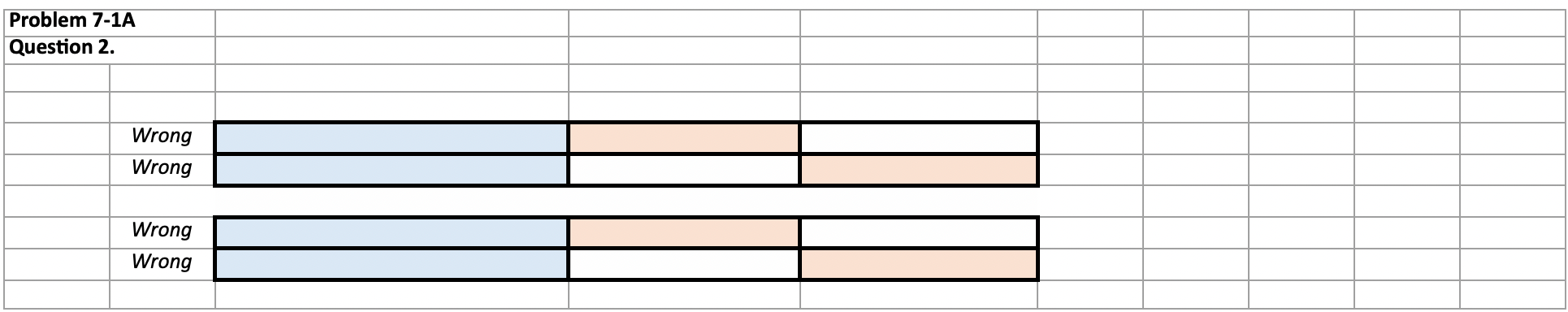

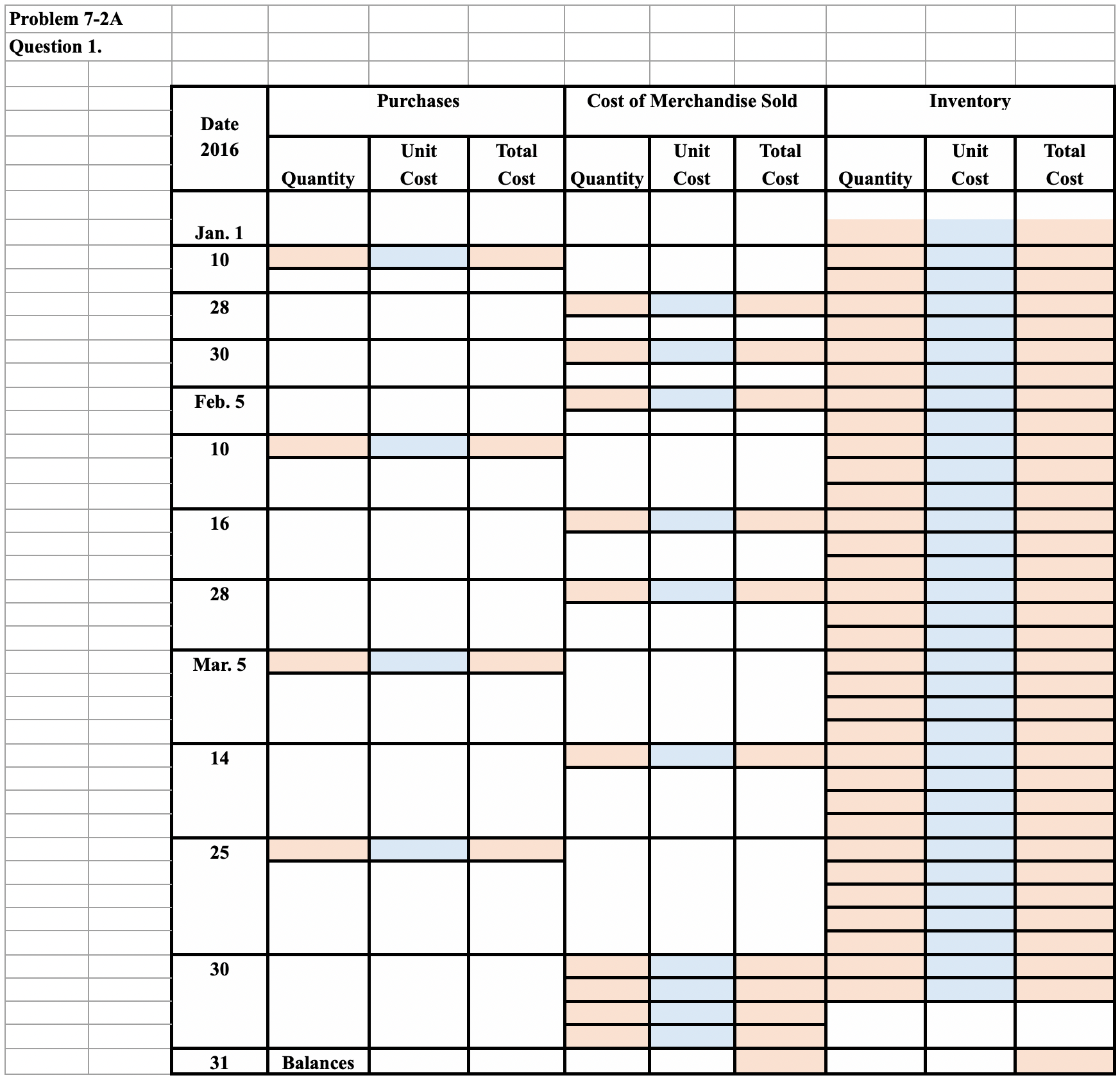

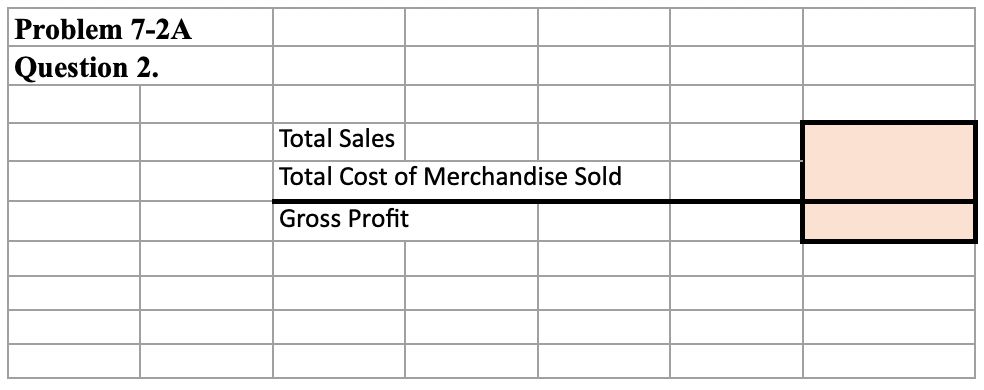

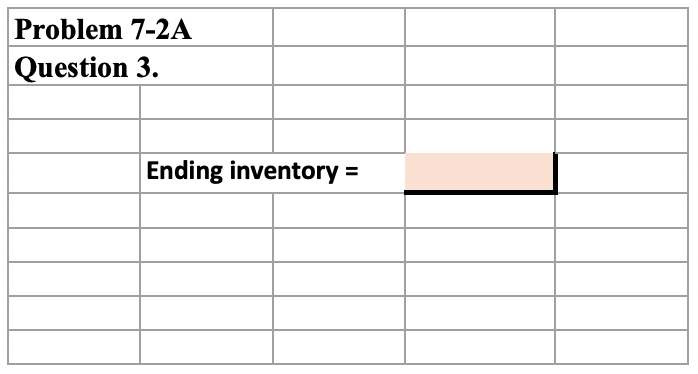

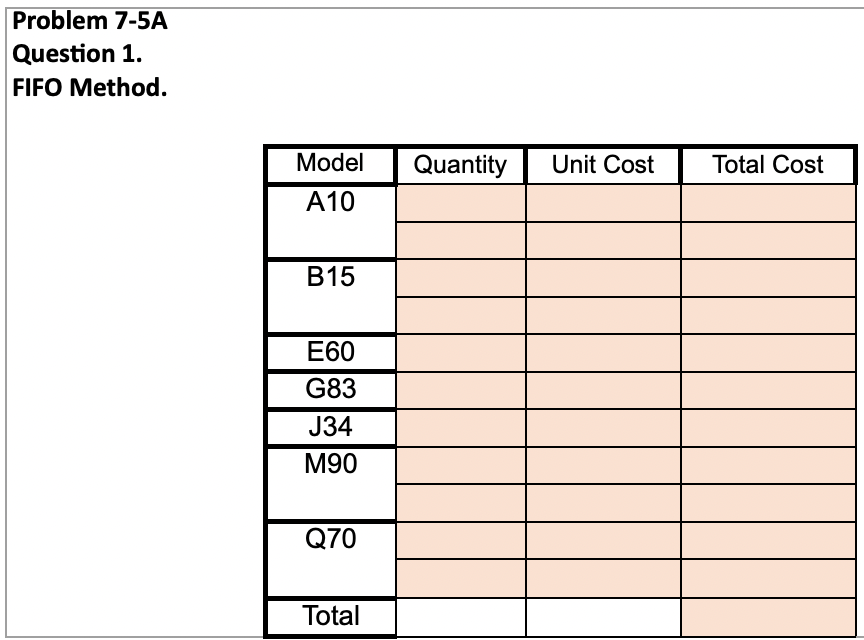

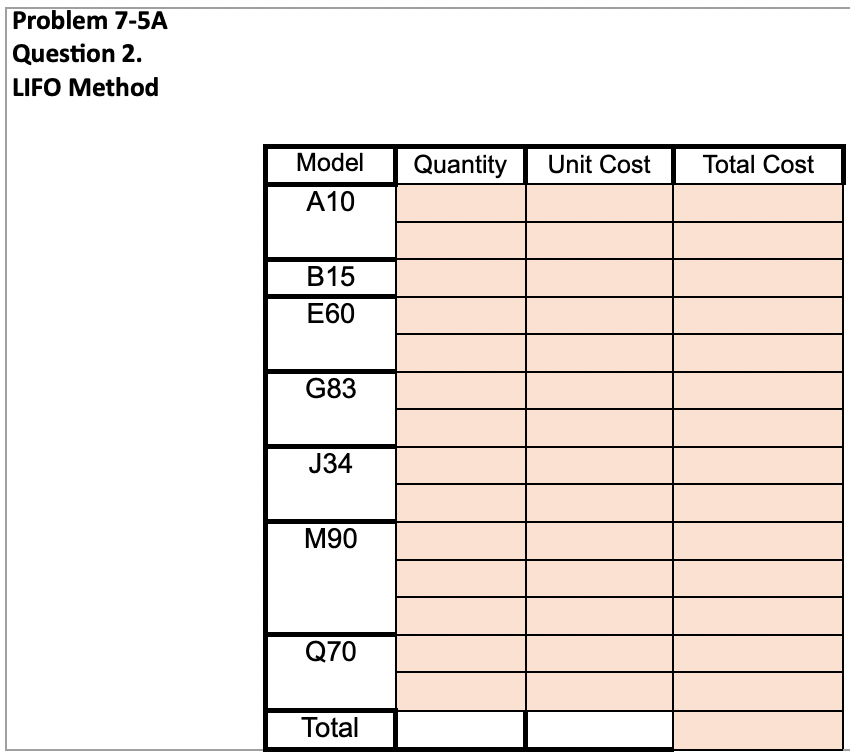

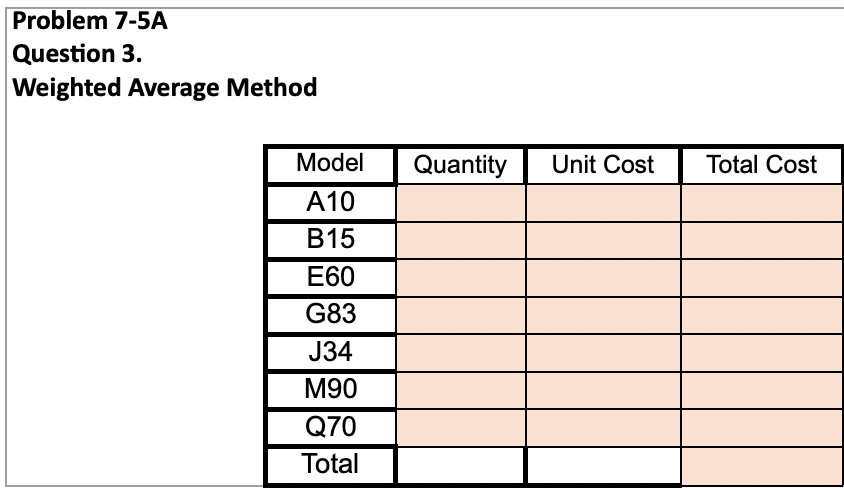

Chapter 7 Problems PR 7-1A FIFO perpetual inventory The beginning inventory at Funky Party Supplies and data on purchases and sales for a three-month period ending March 31, 2016, are as follows: Transactio Number Per Date n of Units Unit Total 1-Jan Inventory 2,500 $60 150,000 10 Purchase 7,500 68 510,000 28 Sale 3,750 120 450,000 30 Sale 1,250 120 150,000 5-Feb Sale 500 120 60,000 1,260,00 10 purchase 18,000 70 0 1,125,00 16 Sale 9,000 125 0 1,062,50 28 Sale 8,500 125 0 5-Ma 1,074,00 Purchase 15,000 71.6 0 1,250,00 14 Sale 10,000 125 0 25 Purchase 2,500 72 180,000 1,093,75 30 Sale 8,750 125 0 Instructions 1. Record the inventory, purchases, and cost of merchandise sold data in a perpetual inventory record, using the first-in, first-out method. 2. Determine the total sales and the total cost of merchandise sold for the period. Journalize the entries in the sales and cost of merchandise sold accounts. Assume that all sales were on account. 3. Determine the gross profit from sales for the period. 4. Determine the ending inventory cost as of March 31, 2016. PR 7-2A LIFO perpetual inventory The beginning inventory at Funky Party Supplies and data on purchases and sales for a three-month period are shown in Problem 7-1A. Warren, C. S., Reeve, J. M., & Duchac, J. (2016). Accounting (26 ed.). Boston, MA: Cengage Learning.Instructions 1. Record the inventory, purchases, and cost of merchandise sold data in a perpetual inventory record, using the last-in, first-out method. 2. Determine the total sales, the total cost of merchandise sold, and the gross profit from sales for the period. 3. Determine the ending inventory cost as of March 31, 2016. PR 7-5A Periodic inventory by three methods Dymac Appliances uses the periodic inventory system. Details regarding the inventory of appliances at November 1, 2015, purchases invoices during the next 12 months, and the inventory count at October 31, 2016, are summarized as follows: Purchases Invoices Inventory, Inventory, Model November 1 1st 2nd 3rd October 31 1 at 4 at 4 at A10 $64 $70 $76 4 at 3 at 6 at B15 8 at $176 158 170 184 8 3 at 15 at 9 at E60 3 at 75 65 68 70 5 6 at 5 at 10 at G83 7 at 242 250 260 259 10 at 16 at 16 at J34 12 at 240 246 267 270 15 2 at 3 at 3 at M90 2 at 108 110 128 130 5 4 at 4 at 7 at Q70 5 at 160 170 175 180 Co Instructions 1. Determine the cost of the inventory on October 31, 2016, by the first-in, first-out method. If the inventory of a particular model comprises one entire purchase plus a portion of another purchase acquired at a different unit cost, use a separate line for each purchase. 2. Determine the cost of the inventory on October 31, 2016, by the last-in, first-out method, following the procedures indicated in (1). Warren, C. S., Reeve, J. M., & Duchac, J. (2016). Accounting (26 ed.). Boston, MA: Cengage Learning.3. Determine the cost of the inventory on October 31, 2016, by the weighted average cost method, using the columnar headings indicated in (1). Warren, C. S., Reeve, J. M., & Duchat, J. (2016). Accounting (26 ed.). Boston, MA: Cengage Learning.Problem 7-1A Question 1. Purchases Cost of merchandise sold Inventory Date 2016 Unit Total Unit Total Unit Total Quantity Cost Cost Quantity Cost Cost Quantity Cost Cost Jan. 1 10 28 30 Feb. 5 10 16 28 Mar. 5 14 25 30 31 BalancesProblem 7-1A Question 2. Wrong Wrong Wrong WrongProblem 7-1A Question 3. Gross Profit =Problem 7-1A Question 4. Ending inventory =Problem 7-2A Question 1. Purchases Cost of Merchandise Sold Inventory Date 2016 Unit Total Unit Total Unit Total Quantity Cost Cost Quantity Cost Cost Quantity Cost Cost ____ '-- ____ ____ \"______ ____ 10 ___ __ ___ ___ ___ ____ ___ ___ ____ __ ___ __ ___ 14 ____ __ ___ ___ ._ __ __ __ ___ Problem 7-2A Question 2. Total Sales Total Cost of Merchandise Sold Gross ProfitProblem 7-2A Question 3. Ending inventory =Problem 7-5A Question 1. FIFO Method. Model Quantity Unit Cost Total Cost A10 B15 E60 G83 J34 M90 Q70 TotalProblem 7-5A Question 2. LIFO Method Model Quantity Unit Cost Total Cost A10 B15 E60 G83 J34 M90 Q70 TotalProblem 7-5A Question 3. Weighted Average Method Model Quantity Unit Cost Total Cost A10 B15 E60 G83 J34 M90 Q70 Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts