Question: PROBLEM D 18 POINTS MONEY INC , A CALENDAR YEAR S CORPORATION IN DALLAS TEXAS, HAS TWO UNRELATED SHAREHOLDER, A AND B , EACH OWING

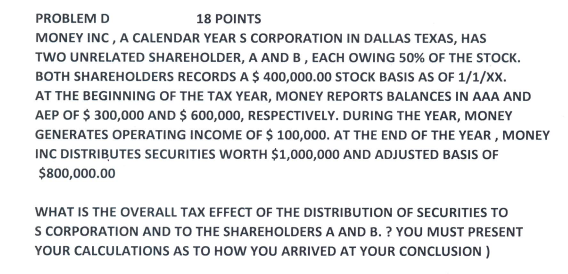

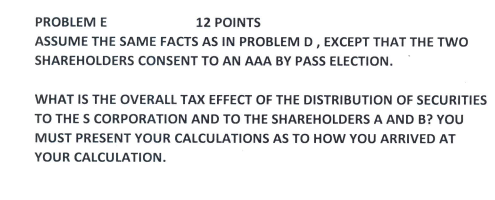

PROBLEM D 18 POINTS MONEY INC , A CALENDAR YEAR S CORPORATION IN DALLAS TEXAS, HAS TWO UNRELATED SHAREHOLDER, A AND B , EACH OWING 50\\% OF THE STOCK. BOTH SHAREHOLDERS RECORDS A \\( \\$ 400,000.00 \\) STOCK BASIS AS OF \\( 1 / 1 / \\mathrm{XX} \\). AT THE BEGINNING OF THE TAX YEAR, MONEY REPORTS BALANCES IN AAA AND AEP OF \\( \\$ 300,000 \\) AND \\( \\$ 600,000 \\), RESPECTIVELY. DURING THE YEAR, MONEY GENERATES OPERATING INCOME OF \\( \\$ 100,000 \\). AT THE END OF THE YEAR, MONEY INC DISTRIBUUTES SECURITIES WORTH \\$1,000,000 AND ADJUSTED BASIS OF \\( \\$ 800,000.00 \\) WHAT IS THE OVERALL TAX EFFECT OF THE DISTRIBUTION OF SECURITIES TO S CORPORATION AND TO THE SHAREHOLDERS A AND B. ? YOU MUST PRESENT YOUR CALCULATIONS AS TO HOW YOU ARRIVED AT YOUR CONCLUSION ) \\( \\begin{array}{ll}\\text { PROBLEM E } & 12 \\text { POINTS }\\end{array} \\) ASSUME THE SAME FACTS AS IN PROBLEM D , EXCEPT THAT THE TWO SHAREHOLDERS CONSENT TO AN AAA BY PASS ELECTION. WHAT IS THE OVERALL TAX EFFECT OF THE DISTRIBUTION OF SECURITIES TO THE S CORPORATION AND TO THE SHAREHOLDERS A AND B? YOU MUST PRESENT YOUR CALCULATIONS AS TO HOW YOU ARRIVED AT YOUR CALCULATION

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts