Question: PART 1: Using Excel, create a 5-year annual pro forma income statement for the newly formed Ranger Corporation (sorry - not very creativell) based

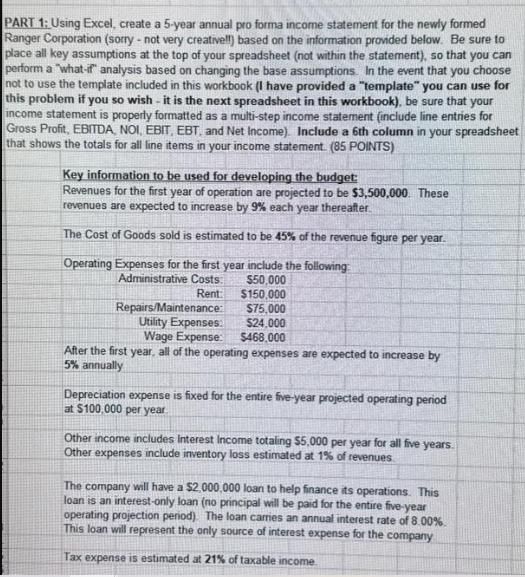

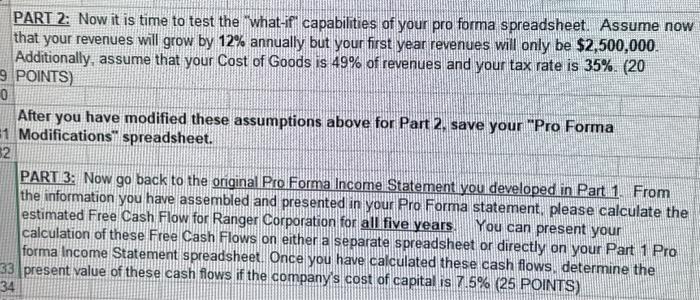

PART 1: Using Excel, create a 5-year annual pro forma income statement for the newly formed Ranger Corporation (sorry - not very creativell) based on the information provided below. Be sure to place all key assumptions at the top of your spreadsheet (not within the statement), so that you can perform a "what-if" analysis based on changing the base assumptions. In the event that you choose not to use the template included in this workbook (I have provided a "template" you can use for this problem if you so wish - it is the next spreadsheet in this workbook), be sure that your income statement is properly formatted as a multi-step income statement (include line entries for Gross Profit, EBITDA, NOI, EBIT, EBT, and Net Income). Include a 6th column in your spreadsheet that shows the totals for all line items in your income statement. (85 POINTS) Key information to be used for developing the budget: Revenues for the first year of operation are projected to be $3,500,000. These revenues are expected to increase by 9% each year thereafter. The Cost of Goods sold is estimated to be 45% of the revenue figure per year. Operating Expenses for the first year include the following Administrative Costs: $50,000 Rent: $150,000 $75,000 $24,000 $468,000 Repairs/Maintenance: Utility Expenses: Wage Expense: After the first year, all of the operating expenses are expected to increase by 5% annually Depreciation expense is fixed for the entire five-year projected operating period at $100,000 per year. Other income includes Interest Income totaling $5,000 per year for all five years. Other expenses include inventory loss estimated at 1% of revenues The company will have a $2,000,000 loan to help finance its operations. This loan is an interest-only loan (no principal will be paid for the entire five-year operating projection period). The loan carries an annual interest rate of 8.00% This loan will represent the only source of interest expense for the company Tax expense is estimated at 21% of taxable income. PART 2: Now it is time to test the "what-if capabilities of your pro forma spreadsheet. Assume now that your revenues will grow by 12% annually but your first year revenues will only be $2,500,000. Additionally, assume that your Cost of Goods is 49% of revenues and your tax rate is 35%. (20 9 POINTS) 0 1 32 After you have modified these assumptions above for Part 2, save your "Pro Forma Modifications" spreadsheet. PART 3: Now go back to the original Pro Forma Income Statement you developed in Part 1. From the information you have assembled and presented in your Pro Forma statement, please calculate the estimated Free Cash Flow for Ranger Corporation for all five years. You can present your calculation of these Free Cash Flows on either a separate spreadsheet or directly on your Part 1 Pro forma Income Statement spreadsheet. Once you have calculated these cash flows, determine the 33 present value of these cash flows if the company's cost of capital is 7.5% (25 POINTS) 34

Step by Step Solution

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Based on the information provided I will help you create a 5year annual pro forma income statement f... View full answer

Get step-by-step solutions from verified subject matter experts