Question: Problem E (2 points each) ABC Company accepted from a customer P600,000 face amount, 9-month, 8% note dated June 15, 20x2. On the same date,

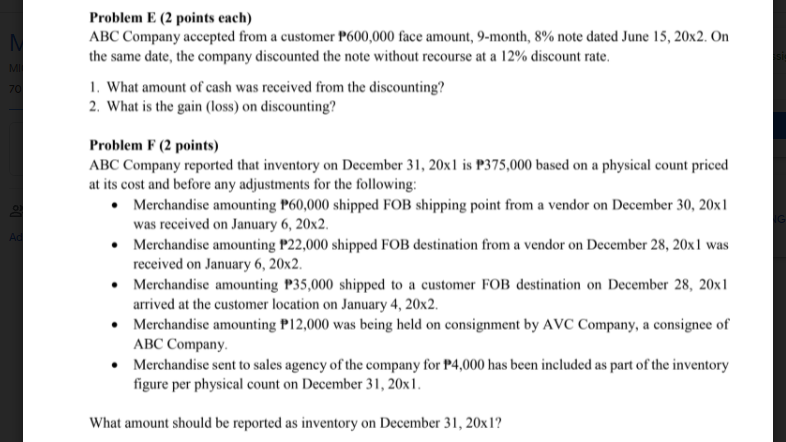

Problem E (2 points each) ABC Company accepted from a customer P600,000 face amount, 9-month, 8% note dated June 15, 20x2. On the same date, the company discounted the note without recourse at a 12% discount rate. 1. What amount of cash was received from the discounting? 2. What is the gain (loss) on discounting? Problem F (2 points) ABC Company reported that inventory on December 31, 20xl is P375,000 based on a physical count priced at its cost and before any adjustments for the following: Merchandise amounting P60,000 shipped FOB shipping point from a vendor on December 30, 20x 1 was received on January 6, 20x2. Merchandise amounting P22,000 shipped FOB destination from a vendor on December 28, 20x I was received on January 6, 20x2. Merchandise amounting P35,000 shipped to a customer FOB destination on December 28, 20x1 arrived at the customer location on January 4, 20x2. Merchandise amounting P12,000 was being held on consignment by AVC Company, a consignee of ABC Company Merchandise sent to sales agency of the company for P4,000 has been included as part of the inventory figure per physical count on December 31, 20x1. What amount should be reported as inventory on December 31, 20x1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts