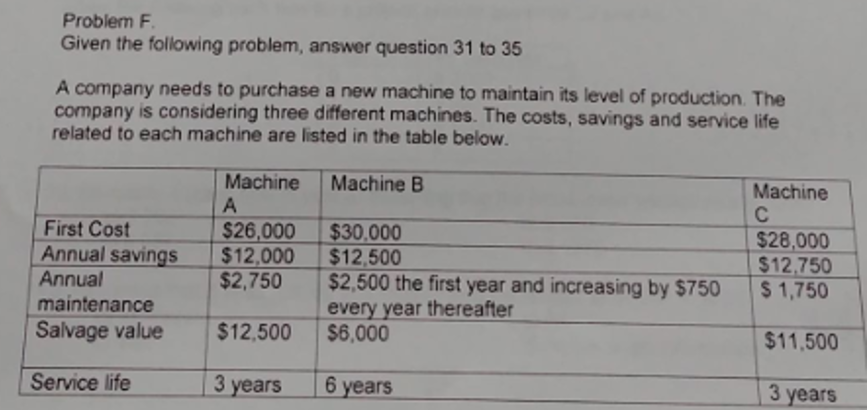

Question: Problem F Given the following problem, answer question 31 to 35 A company needs to purchase a new machine to maintain its level of production.

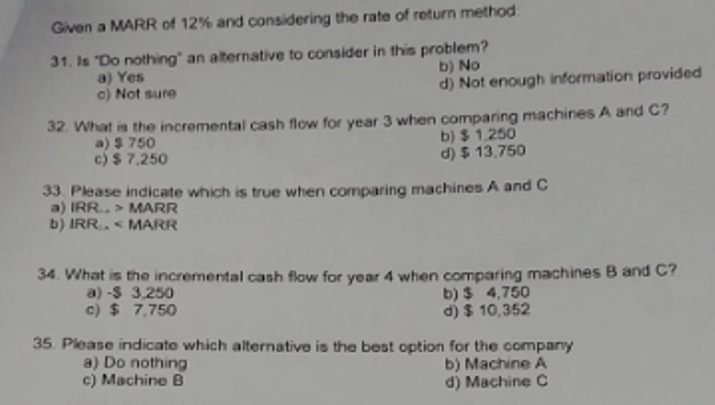

Problem F Given the following problem, answer question 31 to 35 A company needs to purchase a new machine to maintain its level of production. The company is considering three different machines. The costs, savings and service life related to each machine are listed in the table below. Machine Machine B Machine C First Cost Annual savings $26,000 $12,000 $2,750 $30,000 $12,500 $2,500 the first year and increasing by $750 every year thereafter $6,000 $28,000 $12,750 $1,750 Annual maintenance Salvage value $12,500 $11.500 Service life 6 years 3 years 3 years Given a MARR of 12 % and considering the rate of return method: 31. Is "Do nothing" an aternative to consider in this problem? b) No a) Yes c) Not sure d) Not enough information provided 32. What is the incremental cash flow for year 3 when comparing machines A and C? a)$ 750 c)$ 7.250 b) $ 1,250 d)$13,750 33. Please indicate which is true when comparing machines A and C a) IRR.> MARR b) IRR MARR 34. What is the incremental cash flow for year 4 when comparing machines B and C? a) - 3,250 c)$ 7.750 b) $ 4,750 d)$ 10,352 35. Please indicate which alterative is the best option for the company a) Do nothing c) Machine B b) Machine A d) Machine C Problem F Given the following problem, answer question 31 to 35 A company needs to purchase a new machine to maintain its level of production. The company is considering three different machines. The costs, savings and service life related to each machine are listed in the table below. Machine Machine B Machine C First Cost Annual savings $26,000 $12,000 $2,750 $30,000 $12,500 $2,500 the first year and increasing by $750 every year thereafter $6,000 $28,000 $12,750 $1,750 Annual maintenance Salvage value $12,500 $11.500 Service life 6 years 3 years 3 years Given a MARR of 12 % and considering the rate of return method: 31. Is "Do nothing" an aternative to consider in this problem? b) No a) Yes c) Not sure d) Not enough information provided 32. What is the incremental cash flow for year 3 when comparing machines A and C? a)$ 750 c)$ 7.250 b) $ 1,250 d)$13,750 33. Please indicate which is true when comparing machines A and C a) IRR.> MARR b) IRR MARR 34. What is the incremental cash flow for year 4 when comparing machines B and C? a) - 3,250 c)$ 7.750 b) $ 4,750 d)$ 10,352 35. Please indicate which alterative is the best option for the company a) Do nothing c) Machine B b) Machine A d) Machine C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts