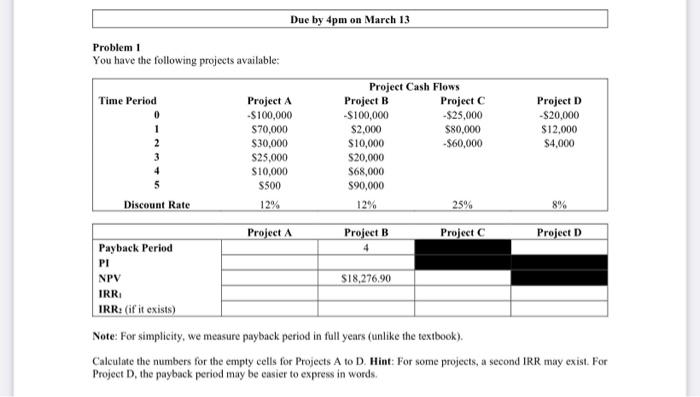

Question: Problem I You have the following projects available: Note: For simplicity, we measure payback period in full years (unlike the textbook). Calculate the numbers for

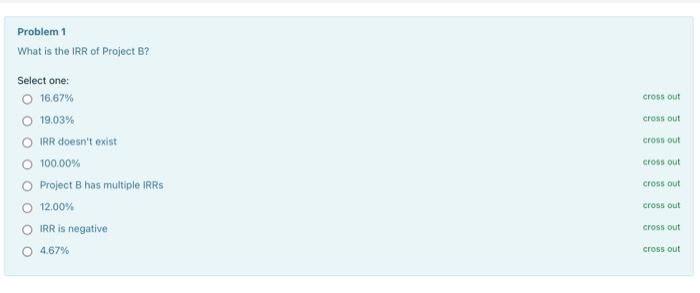

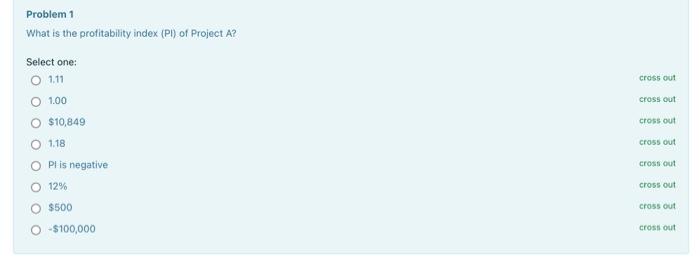

Problem I You have the following projects available: Note: For simplicity, we measure payback period in full years (unlike the textbook). Calculate the numbers for the empty cells for Projects A to D. Hint: For some projects, a second IRR may exist. For Project D, the payback period may be easier to express in words. Problem 1 What is the IRR of Project B? Select one: 16.67% cross out 19.03% cross out IRR doesn't oxist cross out 100.00% cross out Project B has multiple IRRs cross out 12.00% cross out IRR is negative cross out 4.67% cross out Problem-1 What is the NPV of Project C? Select one: $27,437$5,000 The NPV cannot be calculated because the last cash flow is negative $25,000 $600 555,000 $0 $100 Problem 1 What is the protitability index (P) of Project A ? Select one: 1,11 1.00 cross out $10,849 cross out 1.18 cross out Pt is negative cross out 12% cross out $500 cross out $100,000 cross out

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts