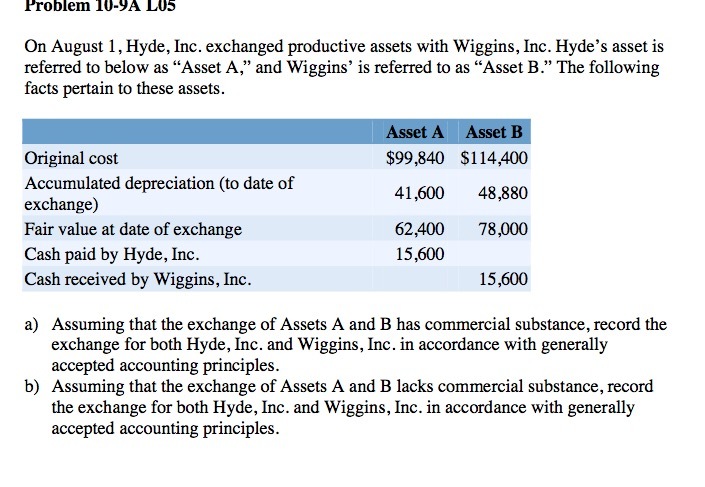

Question: Problem Ill-9A. 1.415 u August 1, Hyde, Inc. exchanged productive assets with Wiggins. Inc. Hyde's asset is referred to below as Asset A, and Wiggins'

Problem Ill-9A. 1.415 u August 1, Hyde, Inc. exchanged productive assets with Wiggins. Inc. Hyde's asset is referred to below as \"Asset A,\" and Wiggins' is referred to as \"Asset B.\" The following facts pertain to these assets. Original cost $99,840 $114,400 Accumulated depreciation {to date of 41 48,3 30 exchange) ,600 Fair value at date of exchange 62,400 78,000 Cash paid by Hyde,1nc. 15,600 Cash received byWiggins, Inc. 15,600 a) Assuming that the exchange of Assets A and B has commercial substance, record the exchange for both Hyde, Inc. and Wiggins, Inc. in accordance with generally accepted accounting principles. 1:) Assuming that the exchange of Assets A and B lacks commercial substance, record the exchange for both Hyde, Inc. and Wiggins, Inc. in accordance with generally accepted accounting principles

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts