Question: Problem In 2018, Barbara Gonzales, age 53, is a self-employed tax attorney and has her qualified business income from her Schedule C of $91,670. She

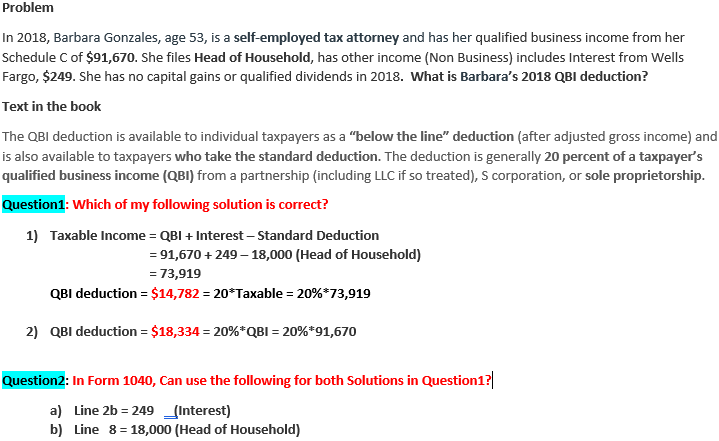

Problem In 2018, Barbara Gonzales, age 53, is a self-employed tax attorney and has her qualified business income from her Schedule C of $91,670. She files Head of Household, has other income (Non Business) includes Interest from Wells Fargo, $249. She has no capital gains or qualified dividends in 2018. What is Barbara's 2018 QBI deduction? Text in the book The QBI deduction is available to individual taxpayers as a "below the line" deduction (after adjusted gross income) and is also available to taxpayers who take the standard deduction. The deduction is generally 20 percent of a taxpayer's qualified business income (QBI) from a partnership (including LLC if so treated), S corporation, or sole proprietorship. Question 1: Which of my following solution is correct? 1) Taxable income = QBI + Interest - Standard Deduction = 91,670 + 249-18,000 (Head of Household) = 73,919 QBI deduction = $14,782 = 20*Taxable = 20%*73,919 2) QBI deduction = $18,334 = 20%*QBI = 20%*91,670 Question2: In Form 1040, Can use the following for both Solutions in Question1?| a) Line 2b = 249 _(Interest) b) Line 8 = 18,000 (Head of Household) Problem In 2018, Barbara Gonzales, age 53, is a self-employed tax attorney and has her qualified business income from her Schedule C of $91,670. She files Head of Household, has other income (Non Business) includes Interest from Wells Fargo, $249. She has no capital gains or qualified dividends in 2018. What is Barbara's 2018 QBI deduction? Text in the book The QBI deduction is available to individual taxpayers as a "below the line" deduction (after adjusted gross income) and is also available to taxpayers who take the standard deduction. The deduction is generally 20 percent of a taxpayer's qualified business income (QBI) from a partnership (including LLC if so treated), S corporation, or sole proprietorship. Question 1: Which of my following solution is correct? 1) Taxable income = QBI + Interest - Standard Deduction = 91,670 + 249-18,000 (Head of Household) = 73,919 QBI deduction = $14,782 = 20*Taxable = 20%*73,919 2) QBI deduction = $18,334 = 20%*QBI = 20%*91,670 Question2: In Form 1040, Can use the following for both Solutions in Question1?| a) Line 2b = 249 _(Interest) b) Line 8 = 18,000 (Head of Household)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts