Question: Problem: Module 2 Textbook Problem 10 Learning Objective: Module 2-7 Show how different inventory cost flow methods (specific identification, FIFO, LIFO, and weighted average) affect

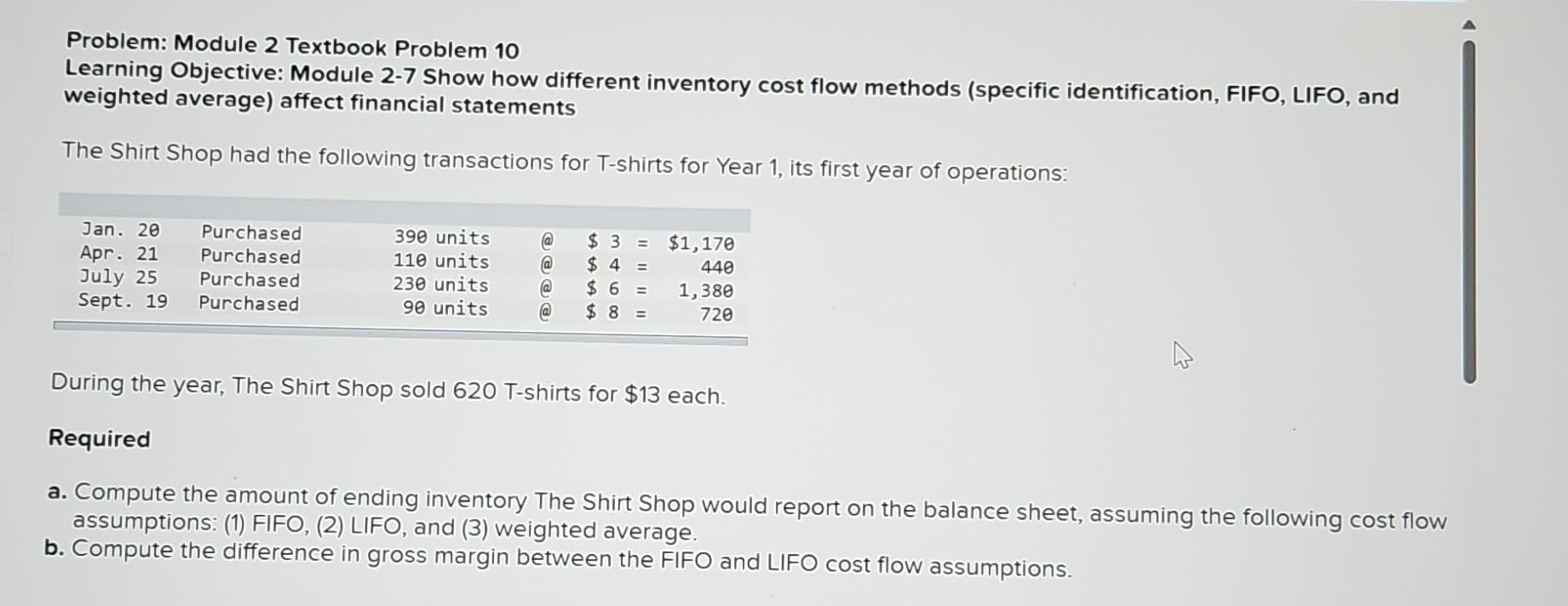

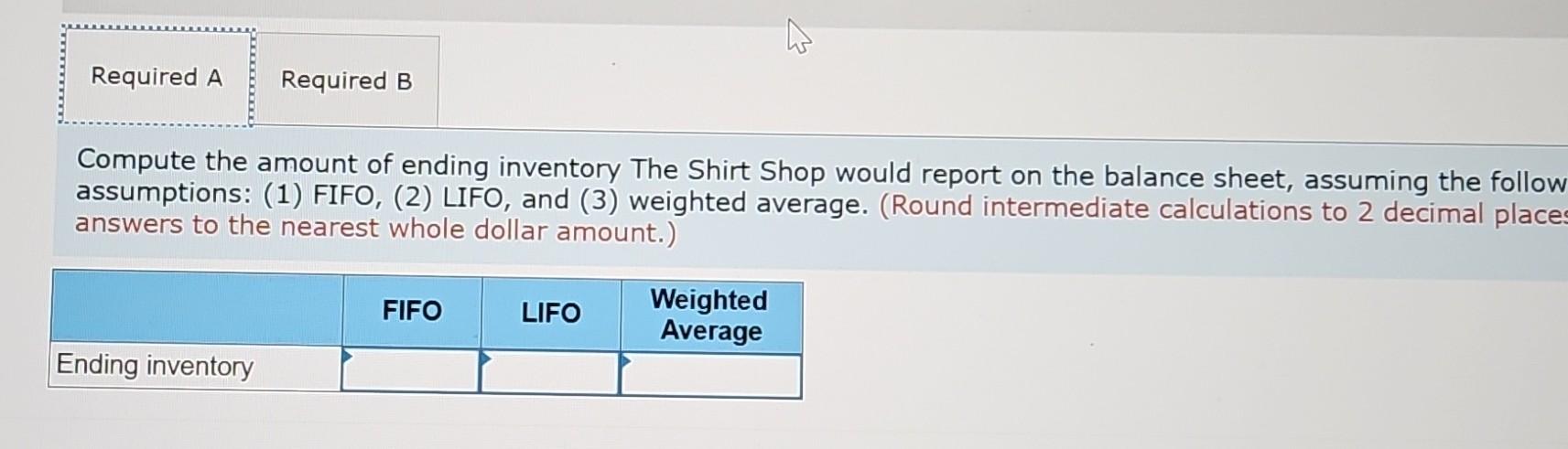

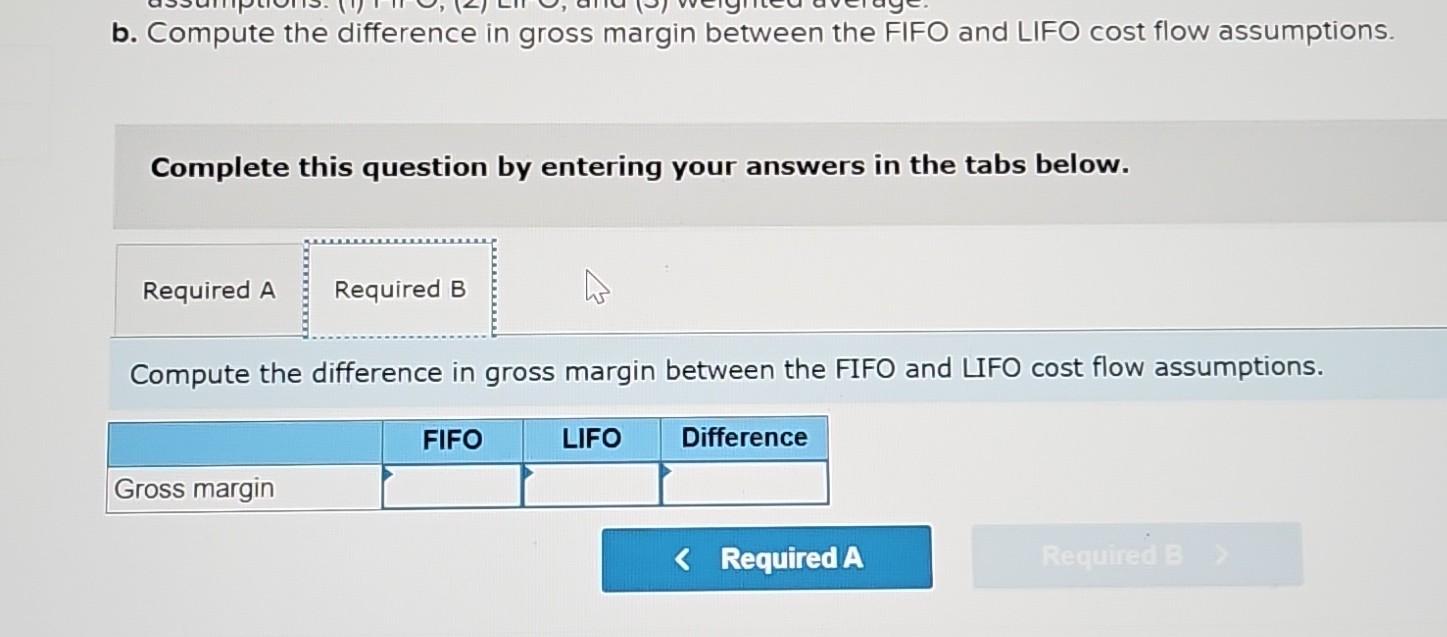

Problem: Module 2 Textbook Problem 10 Learning Objective: Module 2-7 Show how different inventory cost flow methods (specific identification, FIFO, LIFO, and weighted average) affect financial statements The Shirt Shop had the following transactions for T-shirts for Year 1, its first year of operations: During the year, The Shirt Shop sold 620 T-shirts for $13 each. Required a. Compute the amount of ending inventory The Shirt Shop would report on the balance sheet, assuming the following cost flow assumptions: (1) FIFO, (2) LIFO, and (3) weighted average. b. Compute the difference in gross margin between the FIFO and LIFO cost flow assumptions. Compute the amount of ending inventory The Shirt Shop would report on the balance sheet, assuming the follov assumptions: (1) FIFO, (2) LIFO, and (3) weighted average. (Round intermediate calculations to 2 decimal place answers to the nearest whole dollar amount.) b. Compute the difference in gross margin between the FIFO and LIFO cost flow assumptions. Complete this question by entering your answers in the tabs below. Compute the difference in gross margin between the FIFO and LFO cost flow assumptions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts