Question: Problem: Module 7 Textbook Problem 10 Learning Objective: 7-9 Identify similarities and differences in the tax treatment of Scorporations versus partnerships Potato, an individual, is

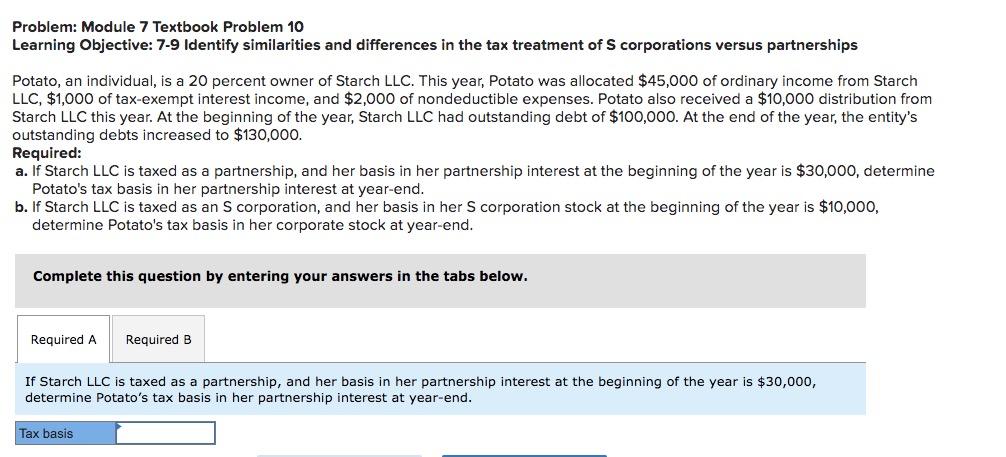

Problem: Module 7 Textbook Problem 10 Learning Objective: 7-9 Identify similarities and differences in the tax treatment of Scorporations versus partnerships Potato, an individual, is a 20 percent owner of Starch LLC. This year, Potato was allocated $45,000 of ordinary income from Starch LLC, $1,000 of tax-exempt interest income, and $2,000 of nondeductible expenses. Potato also received a $10,000 distribution from Starch LLC this year. At the beginning of the year, Starch LLC had outstanding debt of $100,000. At the end of the year, the entity's outstanding debts increased to $130,000. Required: a. If Starch LLC is taxed as a partnership, and her basis in her partnership interest at the beginning of the year is $30,000, determine Potato's tax basis in her partnership interest at year-end. b. If Starch LLC is taxed as an S corporation, and her basis in her s corporation stock at the beginning of the year is $10,000, determine Potato's tax basis in her corporate stock at year-end. Complete this question by entering your answers in the tabs below. Required A Required B If Starch LLC taxed as a partnership, and her basis in her partnership interest at the beginning of the year is $30,000, determine Potato's tax basis in her partnership interest at year-end. Tax basis Complete this question by entering your answers in the tabs below. Required A Required B If Starch LLC is taxed as an S corporation, and her basis in her S corporation stock at the beginning of the year is $10,000, determine Potato's tax basis in her corporate stock at year-end. Tax basis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts