Question: PROBLEM NO. 9-PPE/DEPRECIATION (INTERMEDIATE ACCOUNTING-IFRS - KIESO) DEBBY CORP., a manuffiacturer offi computer parts, has been experiencing growth in the demand ffor its products over

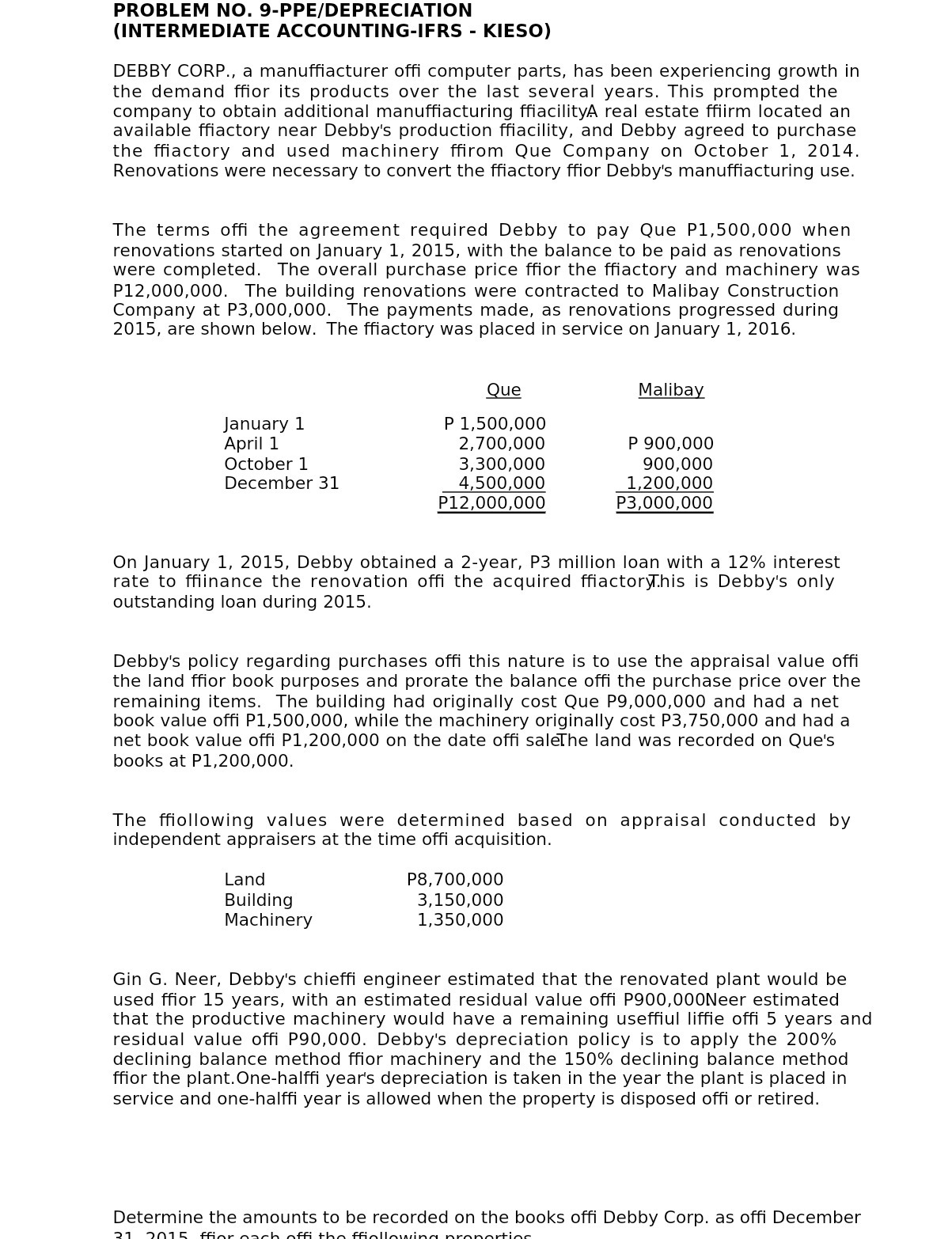

PROBLEM NO. 9-PPE/DEPRECIATION (INTERMEDIATE ACCOUNTING-IFRS - KIESO) DEBBY CORP., a manuffiacturer offi computer parts, has been experiencing growth in the demand ffor its products over the last several years. This prompted the company to obtain additional manuffiacturing ffacilityA real estate ffirm located an available ffiactory near Debby's production ffiacility, and Debby agreed to purchase the ffiactory and used machinery ffirom Que Company on October 1, 2014. Renovations were necessary to convert the ffiactory ffior Debby's manuffiacturing use. The terms offi the agreement required Debby to pay Que P1,500,000 when renovations started on January 1, 2015, with the balance to be paid as renovations were completed. The overall purchase price ffior the ffiactory and machinery was P12,000,000. The building renovations were contracted to Malibay Construction Company at P3,000,000. The payments made, as renovations progressed during 2015, are shown below. The ffiactory was placed in service on January 1, 2016. Que Malibay January 1 P 1,500,000 April 1 ,700,0 P 900,000 October 1 3,300,000 900,000 December 31 4,500,000 1,200,000 P12,000,000 P3,000,000 On January 1, 2015, Debby obtained a 2-year, P3 million loan with a 12% interest rate to ffiinance the renovation offi the acquired ffiactory.his is Debby's only outstanding loan during 2015. Debby's policy regarding purchases offi this nature is to use the appraisal value offi the land ffior book purposes and prorate the balance offi the purchase price over the remaining items. The building had originally cost Que P9,000,000 and had a net book value offi P1,500,000, while the machinery originally cost P3,750,000 and had a net book value offi P1,200,000 on the date offi saleThe land was recorded on Que's books at P1,200,000. The ffiollowing values were determined based on appraisal conducted by independent appraisers at the time offi acquisition. Land P8, 700,000 Building 3,150,000 Machinery 1,350,000 Gin G. Neer, Debby's chieffi engineer estimated that the renovated plant would be used ffior 15 years, with an estimated residual value offi P900,000Neer estimated that the productive machinery would have a remaining useffiul liffie offi 5 years and residual value offi P90,000. Debby's depreciation policy is to apply the 200% declining balance method ffior machinery and the 150% declining balance method ffior the plant. One-halffi year's depreciation is taken in the year the plant is placed in service and one-halffi year is allowed when the property is disposed offi or retired. Determine the amounts to be recorded on the books offi Debby Corp. as offi December

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts