Question: problem one please (this is all part of problem 1) Problem One Tar Company has the following transactions in regards to intangible assets during 2022.

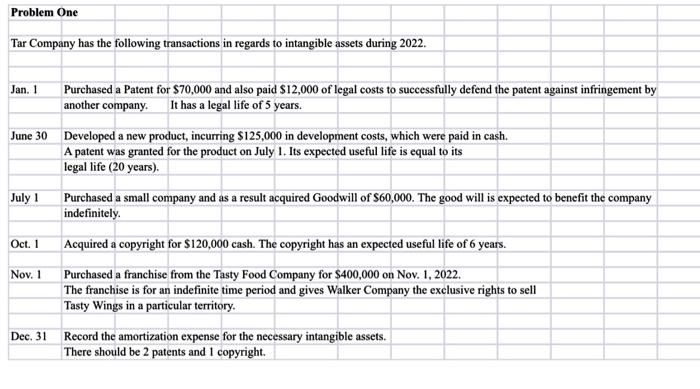

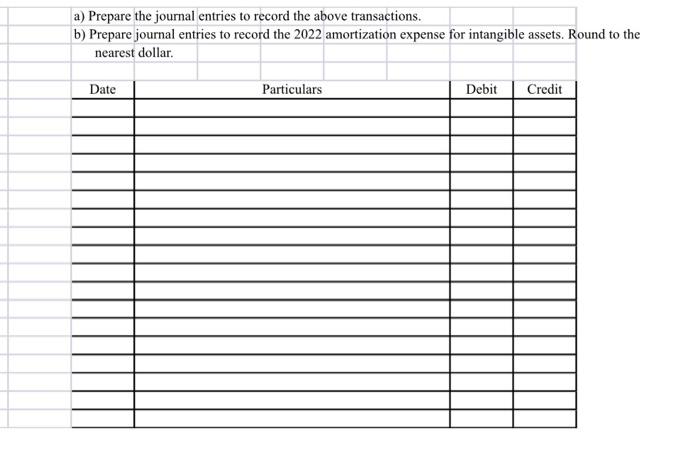

Problem One Tar Company has the following transactions in regards to intangible assets during 2022. Jan. 1 Purchased a Patent for $70,000 and also paid $12,000 of legal costs to successfully defend the patent against infringement by another company. It has a legal life of 5 years. June 30 Developed a new product, incurring $125,000 in development costs, which were paid in cash. A patent was granted for the product on July 1. Its expected useful life is equal to its legal life (20 years). July 1 Purchased a small company and as a result acquired Goodwill of $60,000. The good will is expected to benefit the company indefinitely. Oct. 1 Acquired a copyright for $120,000 cash. The copyright has an expected useful life of 6 years. Nov. 1 Purchased a franchise from the Tasty Food Company for $400,000 on Nov. 1, 2022. The franchise is for an indefinite time period and gives Walker Company the exclusive rights to sell Tasty Wings in a particular territory. Dec. 31 Record the amortization expense for the necessary intangible assets. There should be 2 patents and 1 copyright. a) Prepare the journal entries to record the above transactions. b) Prepare journal entries to record the 2022 amortization expense for intangible assets. Round to the nearest dollar. Date Particulars Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts