Question: problem one Problem 1 (15 marks) Four and a half years ago, you purchased at par, a 10-year 6% coupon bond that pays semi- annual

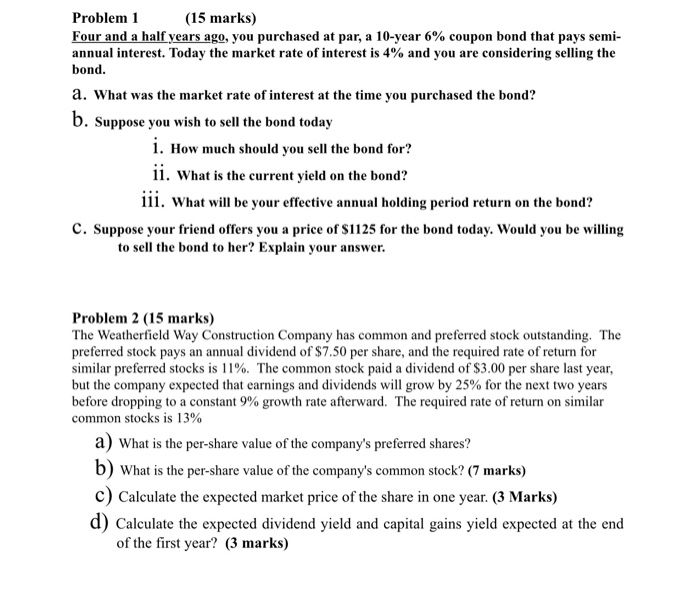

Problem 1 (15 marks) Four and a half years ago, you purchased at par, a 10-year 6% coupon bond that pays semi- annual interest. Today the market rate of interest is 4% and you are considering selling the bond. a. What was the market rate of interest at the time you purchased the bond? b. Suppose you wish to sell the bond today i. How much should you sell the bond for? ii. What is the current yield on the bond? iii. What will be your effective annual holding period return on the bond? C. Suppose your friend offers you a price of $1125 for the bond today. Would you be willing to sell the bond to her? Explain your answer. Problem 2 (15 marks) The Weatherfield Way Construction Company has common and preferred stock outstanding. The preferred stock pays an annual dividend of $7.50 per share, and the required rate of return for similar preferred stocks is 11%. The common stock paid a dividend of $3.00 per share last year, but the company expected that earnings and dividends will grow by 25% for the next two years before dropping to a constant 9% growth rate afterward. The required rate of return on similar common stocks is 13% a) What is the per-share value of the company's preferred shares? b) What is the per-share value of the company's common stock? (7 marks) c) Calculate the expected market price of the share in one year. (3 Marks) d) Calculate the expected dividend yield and capital gains yield expected at the end of the first year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts