Question: Problem One (Review problems) Problem I You just won 200 000 $ in a lottery that you decide to invest. Your advisor suggests 3 possible

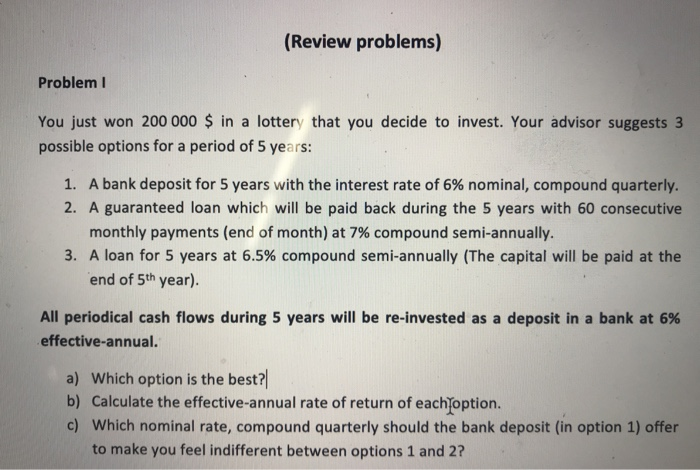

(Review problems) Problem I You just won 200 000 $ in a lottery that you decide to invest. Your advisor suggests 3 possible options for a period of 5 years: 1, A bank deposit for 5 years with the interest rate of 6% nominal, compound quarterly. 2. A guaranteed loan which will be paid back during the 5 years with 60 consecutive monthly payments (end of month) at 7% compound semi-annually. 3. A loan for 5 years at 6.5% compound semi-annually (The capital will be paid at the end of 5th year). All periodical cash flows during 5 years will be re-invested as a deposit in a bank at 6% effective-annual. a) Which option is the best? b) Calculate the effective-annual rate of return of eachoption. c) Which nominal rate, compound quarterly should the bank deposit (in option 1) offer to make you feel indifferent between options 1 and 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts