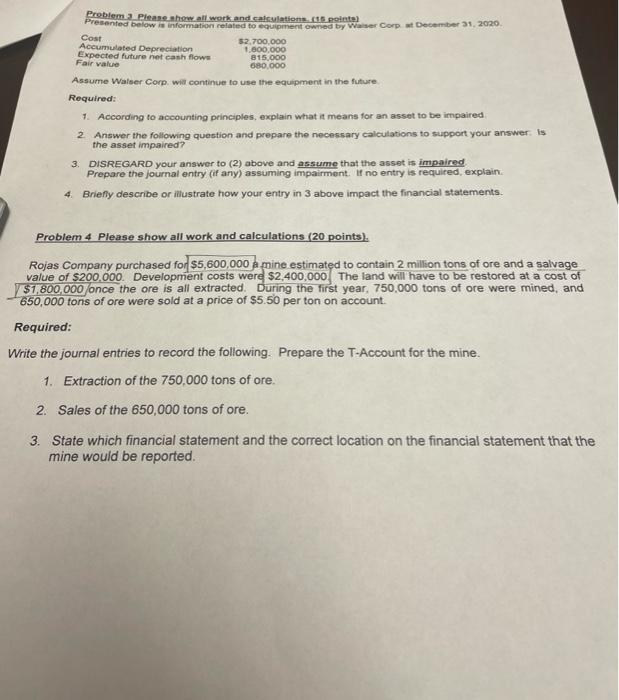

Question: Problem. Please show all work and calculations (15 points) Presented below is information related to equipment owned by Waser Corp December 21, 2020 Cost 52.700.000

Problem. Please show all work and calculations (15 points) Presented below is information related to equipment owned by Waser Corp December 21, 2020 Cost 52.700.000 Accumulated Depreciation 1.800.000 Expected future net cash flows 815.000 Fair value 680,000 Assume Walser Corp will continue to use the equipment in the future Required: 1. According to accounting principles, explain what it means for an asset to be impaired 2 Answer the following question and prepare the necessary calculations to support your answer is the asset impaired? 3. DISREGARD your answer to (2) above and assume that the asset is impaired Prepare the journal entry (if any) assuming impairment. If no entry is required, explain 4. Briefly describe or illustrate how your entry in 3 above impact the financial statements. Problem 4 Please show all work and calculations (20 points). Rojas Company purchased for $5,600,000 a mine estimated to contain 2 million tons of ore and a salvage value of $200.000. Development costs were $2,400,000 The land will have to be restored at a cost of $1,800,000 once the ore is all extracted. During the first year, 750,000 tons of ore were mined, and 650,000 tons of ore were sold at a price of $5.50 per ton on account. Required: Write the journal entries to record the following. Prepare the T-Account for the mine. 1. Extraction of the 750,000 tons of ore. 2. Sales of the 650,000 tons of ore. 3. State which financial statement and the correct location on the financial statement that the mine would be reported

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts